One of the biggest reasons I’ve been against contributing to a Roth IRA is my belief that most people won’t make more money in retirement than while working. As a result, they’re unlikely to pay a higher tax rate in retirement than during their working years.

This belief also assumes that tax rates will stay stable. Since 2009, when I first shared my views on Financial Samurai, tax rates have generally trended lower. Just as cutting Social Security benefits is political self-harm, campaigning to raise taxes isn’t a winning strategy for politicians seeking power.

Earning more money in retirement than during your working years requires effort, discipline, consistency, and a bit of good luck. Considering the current state of personal finances in America—which isn’t great—this scenario is unlikely for most people.

Intuitively, many people understand this. However, let’s dive into the numbers to get a clearer picture. I’ll also explore why some of us might very well end up making more in retirement than we did while working. The key is understanding the concept of deferred income and how it is taxed.

Why Most People Will Earn Less in Retirement

Let’s examine the numbers. If we look at the median and average net worth for retirees, it’s logical to conclude that most Americans will earn more while working than when retired.

- The median household income in the U.S. is about $80,000.

- The median individual income is about $43,000.

Now, consider the median net worth of $192,000 (based on the latest Consumer Finance Survey). Using the 4% rule, a safe withdrawal rate, this net worth generates only $7,680 annually.

Fortunately, Social Security provides an average payout of $22,333 per year, and rises with an inflation index each year. Adding these together gives retirees a total income of $30,013 annually.

Compare this to the median individual income of $43,000. Not only is $30,013 significantly lower, but it’s also about 30% less. The median net worth would need to be at least $325,000 higher, or over $517,000, for the typical retiree to make more in retirement.

On the bright side, retirees earning $30,013 annually don’t need to worry much about taxes due to the standard deduction and lower marginal tax rates at this income level. I estimate that individuals can amass up to a $1.5 million portfolio and still not have to pay much if any taxes in retirement.

WhyYou Might Earn More in Retirement Than While Working

While most Americans earn less in retirement, you aren’t most people. Readers of personal finance sites like this one are likely saving far more and investing more strategically than the average individual. We’re a nerdy bunch who care immensely about our financial future.

Thanks to the power of compounding, decades of disciplined saving and investing could result in you earning far more in retirement than you ever anticipated.

The Power of Compounding

Let’s illustrate compounding’s incredible potential. Suppose you invest $100,000 and earn an annual return of 10%. The example assumes no additional contributions after the initial $100,000 investment.Here’s how your wealth grows over time:

- Year 1: $100,000 → $110,000

- Year 10: $100,000 → ~$259,000

- Year 20: $100,000 → ~$672,000

- Year 30: $100,000 → ~$1.74 million

- Year 40: $100,000 → ~$4.52 million

- Year 50: $100,000 → ~$11.74 million

It might take 30 years to reach your first million, but by Year 50, compounding adds millions annually to your portfolio. Starting early and staying invested are key to building significant wealth.

Why Withdrawals Are Considered Income

Another reason you could earn more in retirement is the tax treatment of withdrawals. This point didn’t fully hit me until I spoke with Bill Bengen, creator of the 4% Rule, and wrote another post on minimizing taxes when withdrawing from retirement portfolios.

Withdrawals from 401(k)s and traditional IRAs are classified as ordinary income, not capital gains. Why?

- Contributions were pre-tax: You didn’t pay income tax on contributions, so taxes are deferred until withdrawal.

- Growth was tax-deferred: The IRS lets investments grow tax-free in these accounts, but it recaptures taxes later by treating withdrawals as income.

Once you think about 401(k) and IRA withdrawals as deferred income, it should now make sense as to why the withdrawals aren’t taxed as capital gains. Heck, think about your entire 401(k) and IRA balance as a big pot of tax deferred income the IRS is just waiting to get their hands on if you will.

Because of these rules, large 401(k) or IRA balances can result in significant taxable income during retirement, especially when factoring in Required Minimum Distributions (RMDs). Let’s now go through an example how how a retiree could make more in retirement.

Example Of A Retiree Earning More in Retirement

Here’s how the combination of RMDs, Social Security, and a large 401(k) could lead to higher retirement income:

Working Years:

- Annual Salary: $120,000

- 401(k) Contributions: $20,000 (pre-tax average annual contribution)

- Take-Home Pay After Contributions: $100,000

Retirement Years:

- 401(k) Balance: $2 million (after 30 years of growth)

- Social Security: $35,000 annually

- RMDs: At age 75, the IRS distribution factor is 22.9.

RMD = $2,000,000 ÷ 22.9 ≈ $87,336

- Total Retirement Income:

- RMD: $87,336

- Social Security: $35,000

- Total: $122,336

In this scenario, the retiree earns $2,336 more in retirement than while working.

Why Retirement Income Also Feels Much Larger

Making $2,336 more a year in retirement (+2%) than while working isn’t a significant amount. However, it feels much large due to the following reasons:

- No Need to Save for Retirement: The $20,000 saved annually during working years is now available for spending. Not saving for retirement once you are retired is one of the biggest “expense” savings working people do not fully account for.

- Lower Tax Rate: Social Security is taxed at a lower rate, and effective tax rates are often reduced for retirees. For example:

- A single filer with $122,336 income pays ~$8,060 in federal taxes after the standard deduction.

- A married filer pays $0 in federal taxes due to higher 0% bracket thresholds and the standard deduction.

- Reduced Expenses: Commuting, work attire, and other work-related costs are eliminated.

- Earning Income Becomes More Enjoyable: For many retirees, part-time work becomes a fulfilling way to stay active. The difference is that you’re no longer working out of necessity but out of choice. This shift brings greater satisfaction as you enjoy being productive, helpful, and connected to your community.

It’s Been A Good Semi-Retirement So Far

Despite earning about 80% less in total income during my first year of retirement, I didn’t feel poorer. In my final two years of work, I had been saving over 70% of my income in anticipation of leaving the workforce. The transition brought immense happiness as I gained full control over my time. I found joy in exploring free parks on weekdays, keeping myself entertained without spending much.

Writing for Financial Samurai has also been far more fulfilling than working in banking. Without anyone dictating my tasks, I can freely explore my creativity and curiosity, writing about topics that truly interest me. While the income is different, the joy of writing makes it worthwhile. When you’re willing to write for free, any online income generated feels like a bonus.

Maybe We’ll Earn More In Retirement After All

Not accounting for 401(k) and IRA withdrawals as income was a blind spot in my earlier arguments. Viewing these withdrawals as deferred income clarifies why they’re taxed as such. For all you super 401(k) and IRA savers, the pot of deferred income the government eventually forces you to tap will likely be substantial!

Moreover, thanks to technology, more retirees are embracing side hustles to generate additional income. The very definition of retirement has evolved—from living a life of leisure to living a life of intentional purpose.

The only thing better than earning more in retirement than while working? Retiring early and making more money while still working!

Readers, do you think you’ll earn more in retirement than while working? Were you aware that withdrawals from 401(k)s and IRAs are taxed as ordinary income, or did you assume they’d be taxed as capital gains since they’re investments?

Reach Financial Freedom Sooner With Boldin

If you’re serious about building wealth and retiring comfortably, consider signing up for Boldin’s powerful retirement planning tools. They offer a free version and a PlannerPlus version for just $120/year—an affordable alternative to hiring a financial advisor. For the paid version, there’s a free 14-days trial.

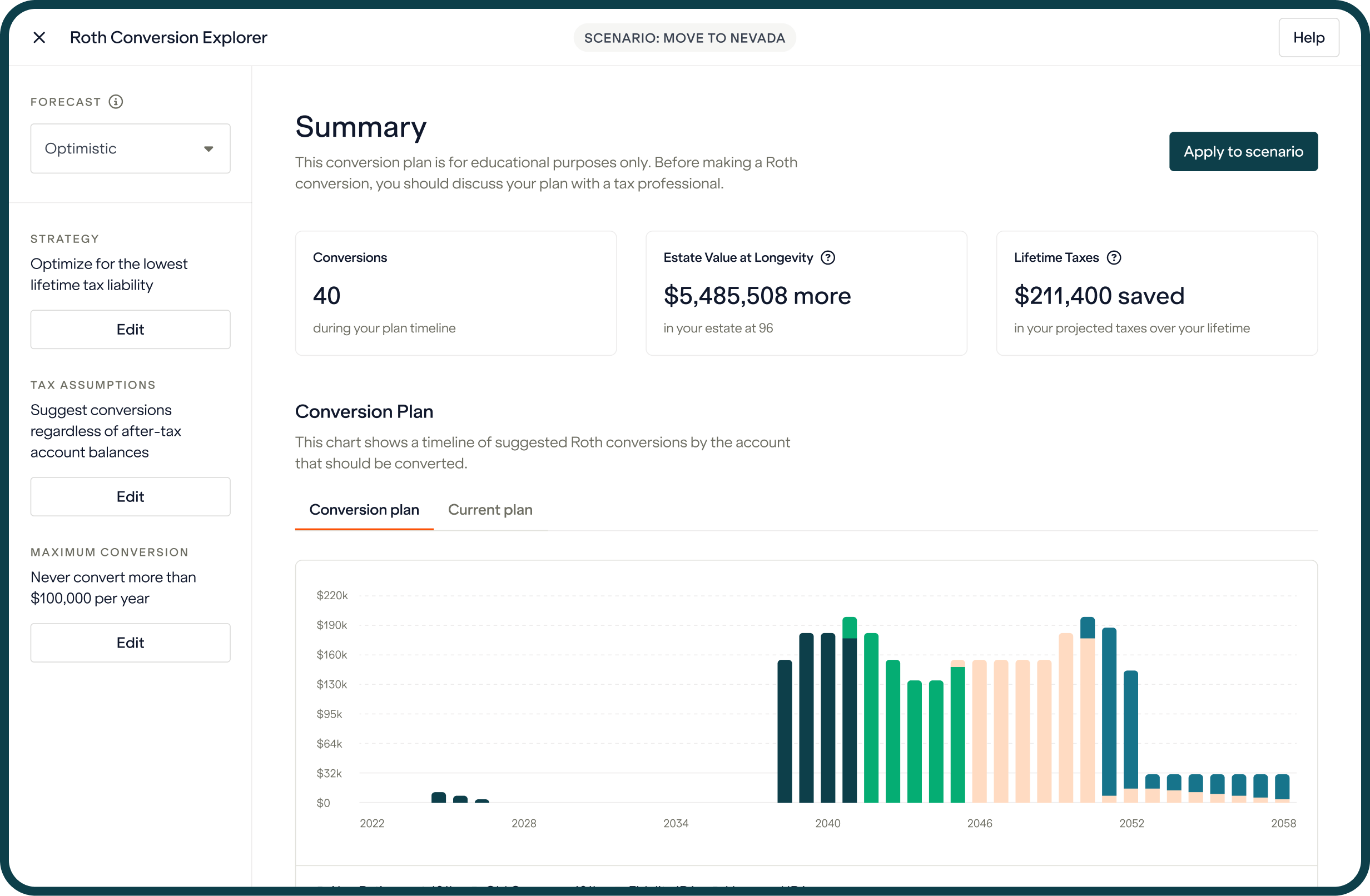

Boldin was specifically designed for retirement planning, providing a holistic approach to financial management. It goes beyond managing your stock and bond portfolio by integrating real estate investments, guiding Roth conversions to minimize taxes, helping with college savings, and addressing other real-life financial scenarios we all face.

As I approach the traditional retirement age, I’ve found Boldin’s tools particularly helpful in deciding how much to convert to a Roth IRA. The ability to model various “what if” scenarios has been invaluable for planning my future, especially for when I’m older and less able to manage my finances.

Why You Could Make More In Retirement Than While Working is a Financial Samurai original post. All rights reserved. Join 60,000+ readers accelerating their path to financial freedom by subscribing to the free Financial Samurai newsletter here.

Read the full article here