During a bull market, most investors get excited about chasing risk. Despite sky-high valuations, there’s a tendency to double down on even riskier bets in the hopes of making outsized gains. That’s human nature. Nobody wants to miss the boat, and everyone thinks they can outsmart the market.

In the process, boring assets like risk-free Treasury bonds usually get pushed aside. After all, who wants to buy a government bond when you can try your luck with a private AI startup or the latest growth stock darling?

But here’s the thing: I’ve been investing since 1996, and I’ve lived through multiple boom-and-bust cycles. Just when you think you can’t lose, you sometimes lose big. And just when you’re convinced the good times will never return, the market surprises you with a rebound.

The real key to being a successful DIY investor isn’t finding the perfect stock—it’s having the discipline to maintain your asset allocation. If you can reduce your emotional volatility and stick to your investing plan, you’ll build far more wealth in the long run than if you’re constantly chasing FOMO.

And that brings me to a point that often gets overlooked: Treasury bonds can appreciate in value too. Don’t sleep on them.

Why Treasuries Deserve More Respect

In a previous post, I talked about how 20-year Treasury bonds yielding ~5% were attractive for retirees or anyone who’s already financially independent and doesn’t want to trade time for money. Google News even picked it up, but the reaction was lukewarm. Most readers weren’t interested—because it’s a bull market. When stocks are roaring higher, nobody wants to hear about bonds.

But as a semi-retiree and disciplined asset allocator, I find any risk-free return above 4% to be highly attractive. Think about it: I believe in the 4% safe withdrawal rate, even though at most I’ve ever withdrawn is 2%. If I can earn 4% on my capital without touching principal, I essentially guarantee myself lifetime financial security. That peace of mind is priceless.

It also means that if my kids end up getting rejected from college and can’t find jobs, they’ll still inherit plenty. Worst case, they can sit around playing video games in the paid-off homes I bought for them before they were born. Not ideal, but at least they won’t starve.

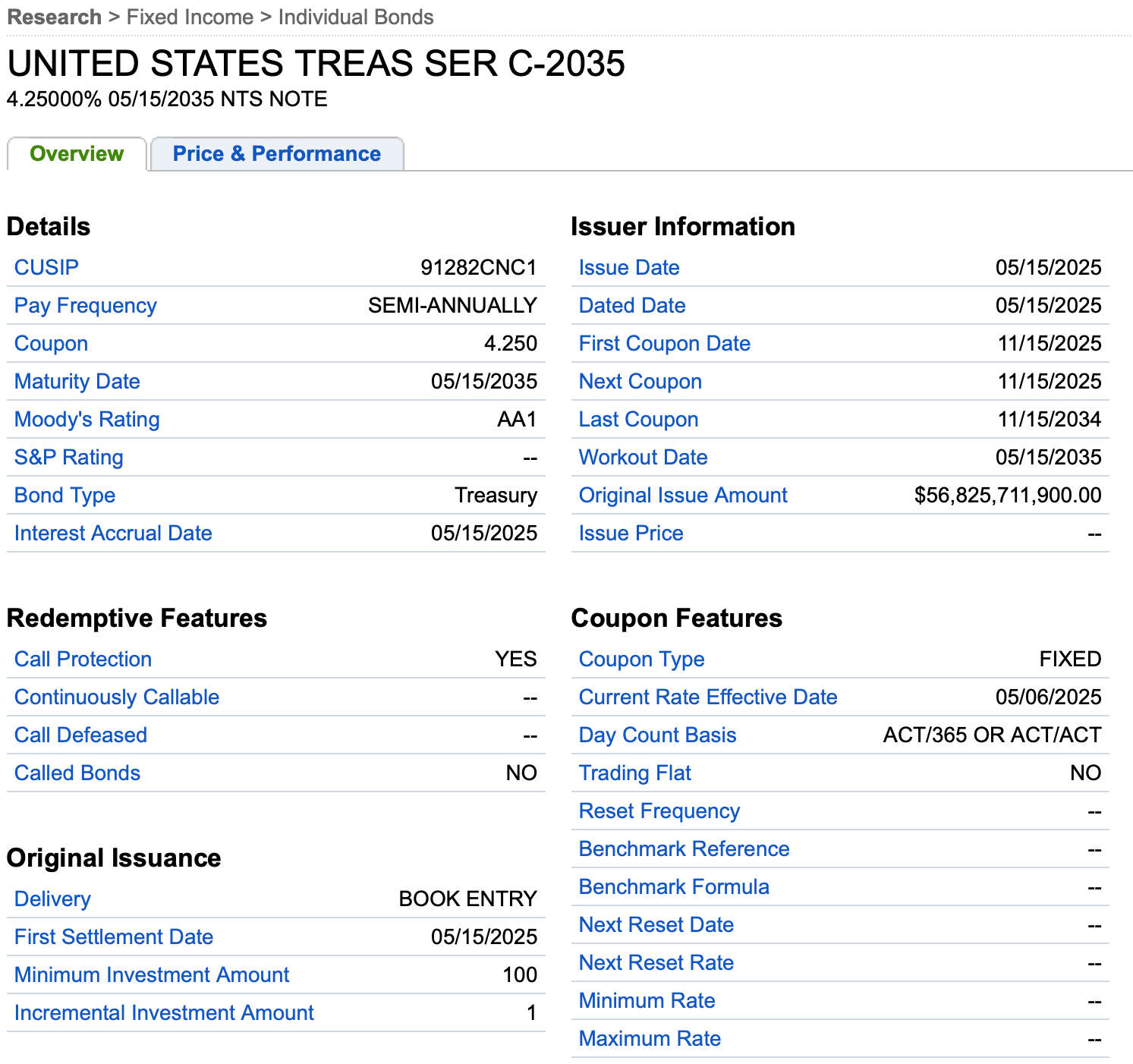

Because I practice what I preach, I bought $150,000 worth of 10-year Treasury bonds yielding 4.25% at the end of June on the secondary market. I’d love to lock up 30–40% of my taxable portfolio in Treasuries yielding at least 4%. That gives me a steady foundation of risk-free income, while still leaving 60–70% of the portfolio available for riskier investments like stocks.

For context, this taxable portfolio is what my wife and I rely on to fund our lives as dual unemployed parents. Stability and income are priorities. For me, that’s the ideal setup in retirement.

The Overlooked Free “Call Option” in Bonds

When most people think of Treasury bonds, they imagine clipping coupons and getting their principal back at maturity. And that’s exactly what happens—you earn steady income, and there’s zero default risk. That’s why they’re called “risk-free.”

But here’s what many investors forget: long-duration Treasury bonds come with a free call option.

If interest rates fall, the market value of your bond rises. You don’t have to sell, but you have the option to. That flexibility is powerful.

- Hold to maturity → collect coupon payments and get all your money back.

- Sell before maturity → potentially lock in capital gains if rates have dropped.

This makes long-term Treasuries a two-for-one investment: you get steady income plus upside potential if rates decline.

My Treasury Bond in Action

The $150,542 worth of 10-year Treasuries I bought in June 2025 are already worth about $154,529—a 2.64% gain in just two-and-a-half months as Treasury bond yields have come down. That’s without even counting coupon payments.

I made the investment during a similar time I invested $100,000 in Fundrise Venture, as part of my dumbbell investing strategy. The vast majority of the proceeds came from selling my old house at a profit.

These bonds pay a 4.25% coupon semi-annually. That’s about $3,199 every six months, like clockwork. I’ll keep getting those payments until May 15, 2035, when the bond matures and I get my $150,542 back in full.

Earning guaranteed money while doing nothing feels like a dream come true, especially now that I’m growing tired of being a landlord. I’m thankful to my younger self for diligently saving and investing 50%+ of my income.

But let’s run some scenarios:

- Rates drop 1% (from 4.25% to 3.25%) over two years.

My bond suddenly looks far more attractive. New buyers would only get 3.25% from a fresh 10-year, while mine pays 4.25%. The market adjusts by bidding up my bond’s price by roughly 6.5%. On $150,542, that’s ~$9,785 in gains. Add in two years of coupon payments ($6,398), and I’d be up around $16,183—a 10.75% return, risk-free. - Rates rise 1% (from 4.25% to 5.25%) over two years.

My bond would decline about 5.2% in value. That sounds bad for a risk-free investment, but here’s the kicker: if I just hold until maturity, I still get all my coupons and my principal back. In the meantime, I’d happily buy new Treasuries at 5.25% to lock in even more passive income.

That’s the beauty of Treasuries. Either way, you or I win. Sure, there’s inflation to contend with. However, every investment contends with inflation to calculate a real rate of return.

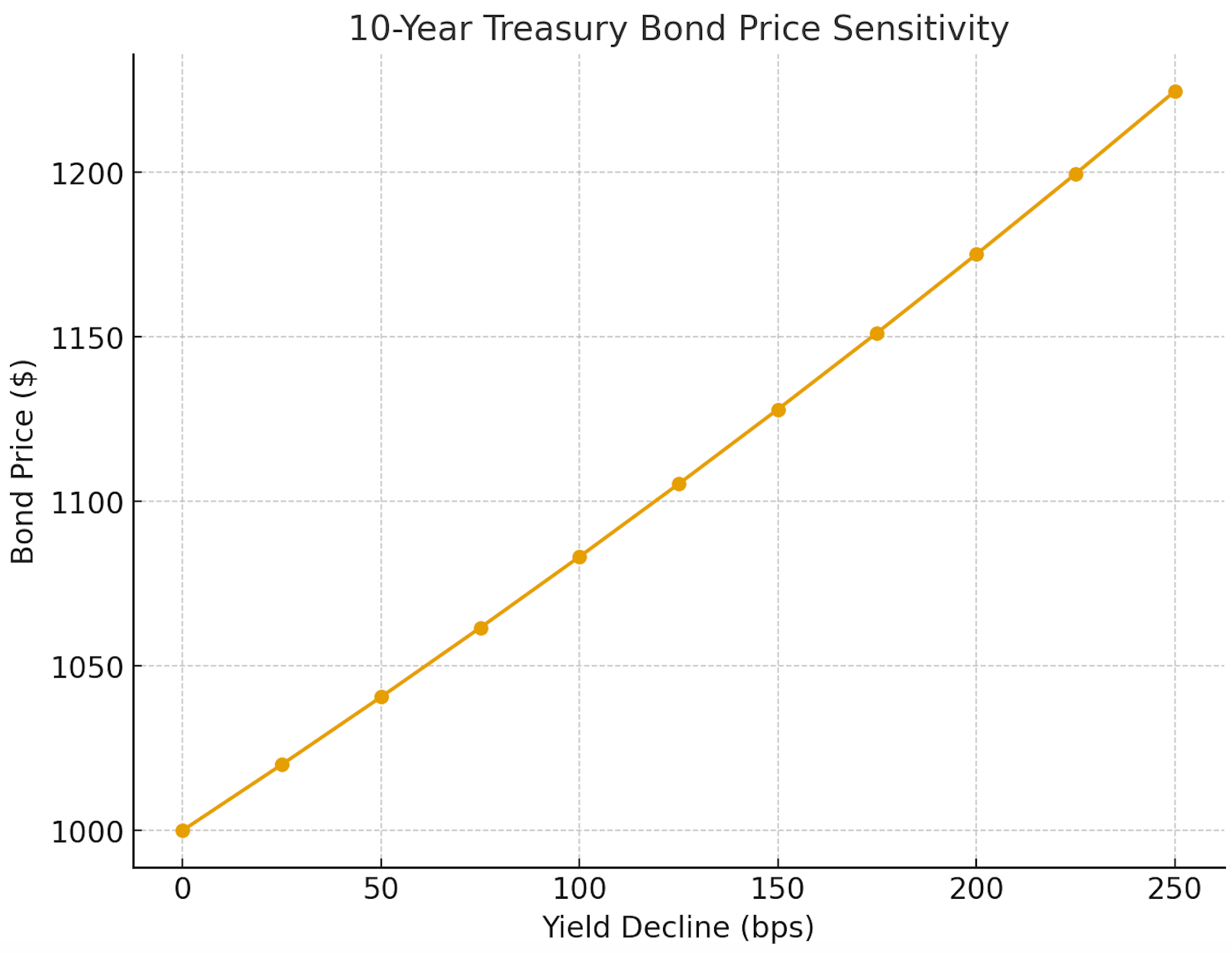

How Much Treasury Bonds Can Appreciate Per Interest Rate Decline

Here’s a look at how a 10-year Treasury bond (4.5% coupon, $1,000 face value) increases in value for each 25 basis point decline in yield:

- 25 bps decline (4.50% → 4.25%): $1,020 (+2.0%)

- 50 bps decline (4.50% → 4.00%): $1,041 (+4.1%)

- 75 bps decline (4.50% → 3.75%): $1,062 (+6.2%)

- 100 bps decline (4.50% → 3.50%): $1,083 (+8.3%)

- 125 bps decline (4.50% → 3.25%): $1,105 (+10.5%)

- 150 bps decline (4.50% → 3.00%): $1,127 (+12.7%)

- 175 bps decline (4.50% → 2.75%): $1,150 (+15.0%)

- 200 bps decline (4.50% → 2.50%): $1,174 (+17.4%)

- 225 bps decline (4.50% → 2.25%): $1,198 (+19.8%)

- 250 bps decline (4.50% → 2.00%): $1,223 (+22.3%)

- 275 bps decline (4.50% → 1.75%): $1,248 (+24.8%)

- 300 bps decline (4.50% → 1.50%): $1,274 (+27.4%)

- 325 bps decline (4.50% → 1.25%): $1,301 (+30.1%)

- 350 bps decline (4.50% → 1.00%): $1,329 (+32.9%)

- 375 bps decline (4.50% → 0.75%): $1,357 (+35.7%)

- 400 bps decline (4.50% → 0.50%): $1,386 (+38.6%)

In other words, if the 10-year Treasury yield falls to 0.6%—its all-time low in March 2020—your 10-year Treasury bond could increase in value by 35% to 40%. More realistically, if yields drop to around 3%–3.5%, you could see roughly 8%–13% in price appreciation on top of the regular coupon payments. Not bad!

Why Higher Yields Are a Gift

The higher rates go, the more excited I get. That may sound strange, but here’s why: I believe the long-term trend for inflation and interest rates is down.

Technology, productivity gains, global coordination, and lessons from past cycles all act as long-term deflationary forces. These should eventually bring interest rates lower. Further, with the Fed restarting its rate cuts, I’m not sure today’s 4% – 5%-risk-free yields may not be around forever.

This is why I’m buying now. Locking in these yields feels like a gift to my future self who might no longer want to life another finger writing posts to help all of you build more wealth and live freer lives.

Beyond Treasuries, I’m investing more in real estate again as they act like a bond plus investment. In other words, real estate has more upside during a declining interest rate environment, while also providing downside protection.

Stocks + Treasuries: The Golden Combo

Right now, investors have the best of both worlds:

- A bull market in stocks.

- High risk-free yields in Treasuries.

That combination doesn’t come around often. But when it does, it is a dream come true for anybody who is FIRE.

When I retired in 2012 with about a $3 million net worth, I felt content with that amount, so I logically adjusted my lifestyle to fit. Remember, you’re not really financially independent if you do nothing to change a suboptimal situation. At the time, the stock market felt dicey, but bond yields were a relatively attractive 3%–4%. Fast forward to today: the stock market is several times higher, and yields are even higher too. Talk about a fortunate setup.

Let’s do a thought experiment. Suppose you’ve diligently saved and invested 50%+ of your income for 35 years. Now you’ve got a $10 million portfolio: $6 million in the S&P 500 and $4 million in Treasuries yielding 4%.

- Stocks at 7% return → $420,000.

- Treasuries at 4% → $160,000.

That’s $580,000 of income a year before taxes, on a $300,000 annual spending budget. You wouldn’t even have to touch principal. Your net worth would just keep compounding until you pass away with far more money than you’ll ever need.

Don’t Underestimate Treasuries

It’s easy to dismiss Treasuries as boring compared to AI startups or meme stocks. But that would be a mistake. They provide steady income, reduce portfolio volatility, and—if rates drop—they can deliver meaningful capital gains.

They’re not flashy, but they don’t need to be. Boring is beautiful when it comes to financial security.

So the next time you’re tempted to overlook Treasuries, remember: they can appreciate in value too. Sometimes, the least exciting investments are the ones that quietly build lasting wealth.

Readers, what are your thoughts on investing in Treasury bonds yielding 4% or more? Do you believe inflation and interest rates are headed lower, or will they rebound higher? And were you aware that Treasuries can also appreciate in value—not just pay steady income?

Suggestions To Build More Wealth

If you believe interest rates will trend lower over the next several years—as I do—investing in bonds and real estate can make a lot of sense. Beyond Treasury bonds, you might consider Fundrise, a private real estate platform managing over $3 billion in assets for more than 380,000 investors. Its portfolio of residential and industrial commercial properties is well-positioned to benefit in a declining rate environment.

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Your shares, ratings, and reviews are appreciated.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. You can also get my posts in your e-mail inbox as soon as they come out by signing up here.

Financial Samurai is among the oldest and largest independently-owned personal finance websites, established in 2009. Everything is written based on firsthand experience and expertise.

Read the full article here