Introduction

The state of personal finance in America is full of uncertainty, and the upcoming election is taking center stage. Almost 60% of all U.S. adults said they think about the election “always” or “often,” likely because, as our research found, so many Americans believe the president can affect their personal finances.

This edition of The State of Personal Finance report will focus on how Americans are looking at their own financial health and at the financial health of the country going into this hotly contested election. We had respondents look back at the past quarter and look forward to the next to determine where America is now and where we might be going.

Executive Summary

- Just over half of Americans (54%) said their financial position has a “great” or “good” amount of influence on how they vote.

- 52% of Americans believe the president has a major impact on their personal finances.

- Only 29% of Americans said they’re better off now financially than they were back in 2020.

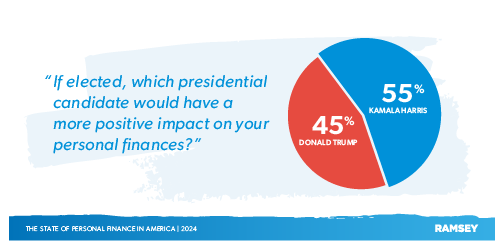

- 55% of Americans believe Vice President Kamala Harris will have a more positive impact on their money as the next president than former President Donald Trump.

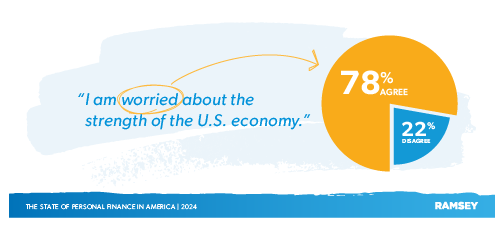

- 78% of U.S. adults said they’re worried about the economy.

- 50% of Americans said they’re prepared financially for a recession.

- Almost half of U.S. workers (43%) are concerned about losing their jobs.

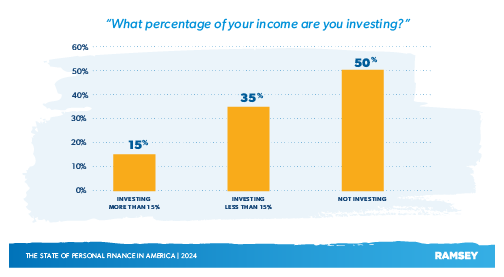

- 1 in 10 U.S. adults are investing 15% or more, and 50% aren’t investing any money at all.

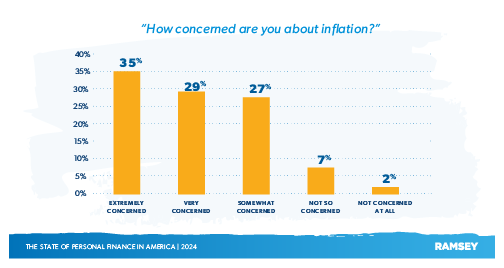

- 64% of Americans are either “extremely” or “very concerned” about inflation.

- 3 in 4 Americans (73%) feel prices are continuing to rise.

- 49% of U.S. adults reported some difficulty paying bills, and 1 in 3 Americans (34%) were late on a bill payment in the last 90 days.

- 36% of Americans said their debt load increased in the past three months, and 34% said they are now carrying more than $10,000 in consumer debt.

- Over half of Americans (54%) said they have accepted that debt is simply a way of life and no big deal.

- On average, Americans plan to spend nearly $800 on gifts this coming holiday season.

- Over half of U.S. adults (54%) said they will make a budget for their holiday spending.

- 35% of Americans said they probably won’t be able to afford their holiday spending and will use credit cards to make up the difference.

Download a PDF version of the report.

Americans Are Voting With Their Pocketbooks

There’s an old saying in politics: “People vote with their pocketbooks.” In other words, Americans vote for the presidential candidate they think will improve their financial situations—especially in a down economy.

Based on the results of our study, that old saying rings true for at least half the country—with 54% of Americans saying the state of their personal finances has a “great” or “good” amount of influence on how they vote. Breaking things down, more men than women (60% vs. 48%) said their finances play a big role in how they vote. And political conservatives were far more likely to vote with their pocketbooks (68%).

A similar number of Americans (52%) also believes the president has a major impact on their personal finances. This belief is pretty evenly split between men and women (54% vs. 50%) as well as between age groups, with Gen Z most likely to believe the president can affect their wallets (57%). And conservatives are more likely to believe in the president’s impact than liberals (67% vs. 52%).

During the closing days of the 1980 presidential election, then-candidate Ronald Reagan asked Americans if they were better off then than they were four years before, trying to get voters thinking about how the country’s economic policies at the time had impacted their lives.

Today, only 29% of Americans said they’re better off now than they were back in 2020. And no matter how the demographics are laid out, no majority believes they are better off now—with just 36% of men and 23% of women saying they’re better off. Millennials were more likely than any other generation to say they’re better off now at 40%. And just 41% of political liberals think they are better off financially—even though the current administration is liberal. The only group that even comes close to a majority is Americans making over $100,000 a year at 47%.

Americans were more likely to say Kamala Harris, the current vice president, will have a more positive impact on their money situations if she’s elected than former President Donald Trump (55% vs. 45%, respectively). Demographically, women (59%), Gen Z (64%) and Americans making less than $50,000 a year (60%) were the most likely to say Harris would positively impact their finances. Political moderates also edged more toward Harris at 58%.

Economic Worries Are Top of Mind in America

It may be difficult to get a majority of Americans to agree on anything, but when it comes to the economy, Americans seem to be in lockstep. Seventy-eight percent said they’re worried about the strength of the U.S. economy, and that concern spans generations and political affiliations. Conservatives were the most likely of any group to be concerned, while liberals were the least likely (90% vs. 67%).

As we looked at individual economic issues, inflation remained a pain point, with 64% of Americans saying they’re “extremely” or “very concerned.” In fact, 3 out of 4 Americans said they feel like prices continue to increase. Conservatives were more likely to say that prices are getting higher (82%), with moderates not too far behind (70%).

When we asked people to rank their financial concerns, inflation remained at the top of the list (28%), with having enough money for retirement coming in at second place (15%), followed by a lack of savings (10%).

With so many people worried about the economy and inflation, it’s not surprising that a potential recession is also on Americans’ radar. Almost half of U.S. workers (43%) said they were concerned about losing their jobs—whether due to a recession or budget cutbacks with their current employer. And there’s virtually no difference in concern between blue-collar workers and white-collar workers (45% vs. 43%). If a recession were to hit the country, half of Americans (50%) said they’re ready financially. Men were more likely to say they were ready than women (61% vs. 41%), as were baby boomers (61%). Americans making less than $50,000 a year feel the least prepared (35%).

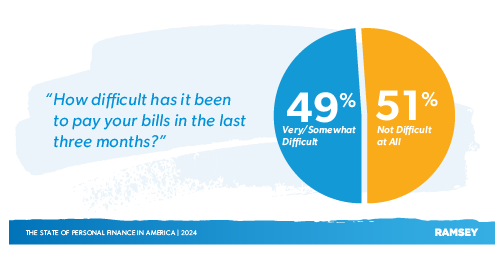

Inflation is definitely putting the squeeze on Americans’ pocketbooks—and that shrinking margin has had consequences in people’s budgets. Half of U.S. adults (49%) said they experienced some difficulty paying bills. Gen Z was the most likely age group to report difficulty in this area (69%), with baby boomers least likely (26%). In addition, 1 in 3 Americans (34%) were late on a bill in the last 90 days, with Gen Z, again, most likely (49%).

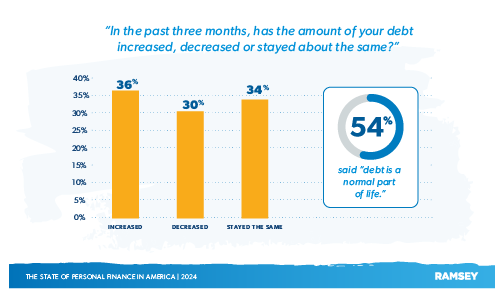

Faced with increasing prices and other challenges to make ends meet, more and more people are resorting to debt to close the gap in their expenses. Over one-third of Americans (36%) said their debt load had increased in the past three months. Another third (34%) said they’re now carrying more than $10,000 in consumer debt, which remained consistent across income groups (range of 31% to 35%).

Carrying that much debt has impacted Americans’ outlook on money. Over half (54%) said they’ve accepted that debt is simply a way of life and no big deal—even though debt makes it more difficult to build wealth and save.

The fact that so many people need every penny they earn (and more) just to stay afloat has no doubt contributed to our finding that few Americans are putting money away for retirement. Only 1 in 10 U.S. adults are investing 15% or more of their income—which is what we recommend to achieve a comfortable retirement. Half (50%) aren’t investing any money at all. The largest demographic investing 15% or more is Americans making over $100,000 a year—and even that figure is low at 37%.

Americans Have Concerns About Christmas

The election may be one of the hottest topics on Americans’ minds, but they’re also looking past the election to the peace, togetherness, and magic of the holiday season. Americans plan to spend an average of $770 on gifts this coming season. Households making over $100,000 plan to spend over $1,300 on average. And families with children at home plan to spend almost twice as much on gifts as those with no children ($1,173 vs. $605).

Those anticipated spending amounts may be large, but if your budget can handle it, you’re free to spread that holiday cheer. Over half of U.S. adults (54%) said they’ll create a budget for their holiday spending. Men (54%) and women (55%) are equally likely to budget for Christmas spending, as are every age bracket and income group. That is, except households making over $100,000 a year, where a fair majority (61%) were planning on budgeting.

However, 1 in 3 Americans (35%) are already aware they won’t be able to afford their holiday spending and plan to use credit cards to make up the difference. Younger generations are more likely to use credit cards for Christmas than their grandparents (48% of Gen Z vs. 19% of baby boomers). Though it may come from the noblest of intentions, that magical Christmas may haunt them for many years to come.

Conclusion

The state of personal finance in America is full of uncertainty. With a hotly contested election looming over everything, Americans have a lot of concerns about the future of the economy as a whole as well as about their own personal financial outlook. What’s particularly concerning is that many Americans give presidents too much credit in their ability to affect personal finances one way or another.

No matter who wins the presidential election, never forget that what goes on in the White House will never be as important as what goes on in your house. Don’t wait for a politician to come and save you (they won’t). And unlike the politicians in D.C., you can balance your budget and make the sacrifices necessary to ensure your family’s future. Take control of your money by sticking to a household budget, paying off your debt, and saving up a fully funded emergency fund. Then you’ll be ready to weather any financial storm—be it naturally occurring or Washington-made.

About the Study

The State of Personal Finance is a quarterly research study conducted by Ramsey Solutions with 1,006 U.S. adults to gain an understanding of the personal finance behaviors and attitudes of Americans. The nationally representative sample was fielded from September 12–16, 2024, using a third-party research panel. Margin of error was ±3.08%.

Since January of 2021, The State of Personal Finance study has seen over 13,000 U.S. adults participate. Research from the study has been shared through hundreds of media outlets ranging from Forbes to Fox News Channel to The New York Times to Good Morning America, as well as in ad campaigns during the NBC coverage of the 2024 Summer Olympics in Paris.

Previous Study Reports

Q4 2023 Report

Q2 2023 Report

Q1 2023 Report

Q4 2022 Report

Q3 2022 Report

Q2 2022 Report

Q1 2022 Report

Read the full article here