If you don’t believe the world will grant your children a fair chance to succeed, you may want to take matters into your own hands as parents. One way is to set them up for financial independence—ideally making them millionaires before they graduate high school, finish college, or leave home.

If your children are millionaires by adulthood, rejections from colleges or employers will matter far less. With financial security, they can live independently, buy a car with cash, and afford a 20% down payment on a median-priced home. Once housing and transportation are covered, most other expenses become manageable.

I know some may find the idea of making their children millionaires unrealistic, even absurd. But in 2025, what feels even more absurd is the existence of different standards for different people based on their identities. I fully support helping those from disadvantaged economic backgrounds and individuals with disabilities. But penalizing people for anything else but who they are feels off.

That’s why the most logical solution is to achieve financial independence—so you and your children don’t have to rely on biased gatekeepers. They are everywhere.

Becoming Millionaires vs. Receiving Millions

It’s important to distinguish between parents simply handing their kids a million dollars and children becoming millionaires through hard work, saving, and investing. I want the latter—so they learn the fundamentals of personal finance and develop a strong, consistent work ethic.

Plenty of families can afford to give their children substantial wealth. I frequently see The Bank of Mom & Dad in action—buying their kids cars, homes, and even covering private school tuition and groceries. That’s certainly their right. However, providing too much financial support can create long-term dependence—the exact opposite of financial independence.

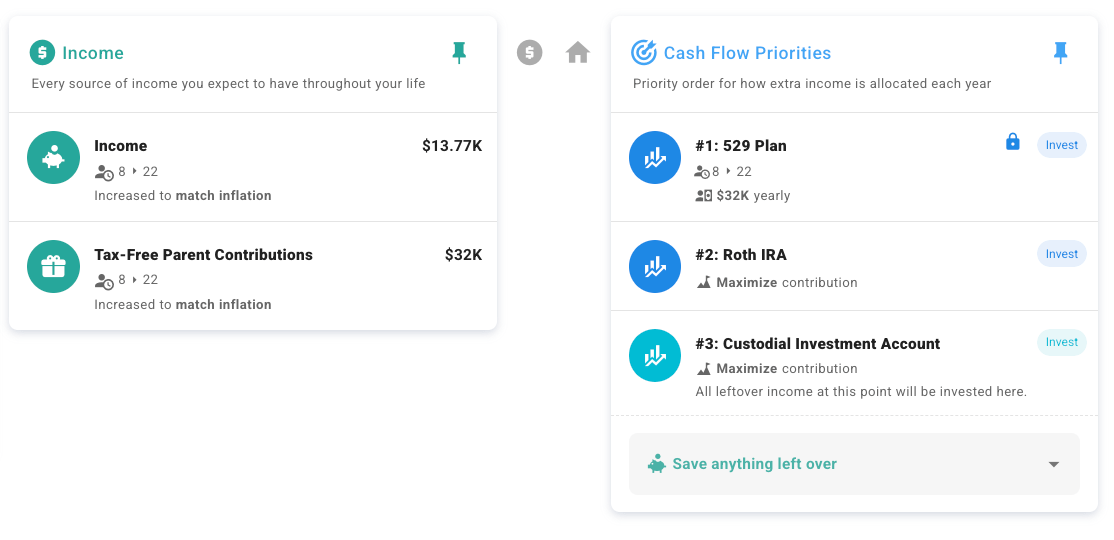

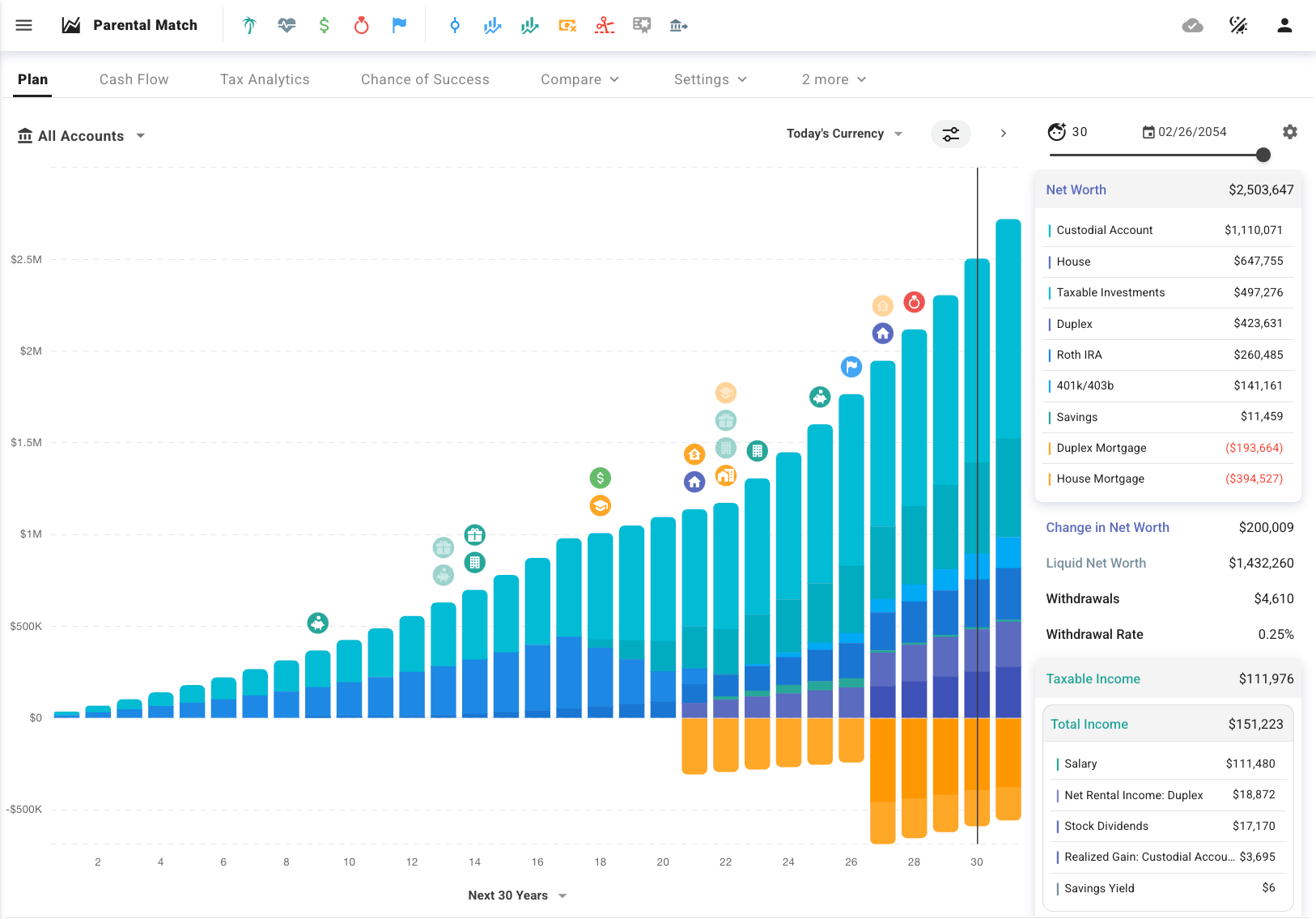

That’s why, using ProjectionLab’s fantastic wealth-planning tools, I want to explore whether it’s even possible to help children become millionaires before they leave home. Once you log onto ProjectionLab, simply input the goals as shown below. Now let’s run through some scenarios!

How A Child Can Become A Millionaire By The Time They Leave The House

Now that we’ve discussed why it may be beneficial for a child to become a millionaire before adulthood, let’s break down exactly how to make it happen. The two primary ways are through work and investing. The sooner a child starts, the better—thanks to the magic of compound growth.

Working As A Child

As a general rule, the Fair Labor Standards Act sets the minimum age for employment at 14, with limits on the hours worked for those under 16. But if a kid wants to become a millionaire by 18, starting work at 14 may be too late.

I worked at McDonald’s for $4/hour at 15. It was a terrible job, and I blew all my money on movies, sports gear, and going on dates. If I had been smarter, I would’ve started working earlier and invested my earnings instead.

But at the time, the Roth IRA had not been invented yet. Further, my parents were not personal finance enthusiasts with million-dollar mindsets. But you are by the very fact that you’re excited reading this post!

Luckily, kids today have more opportunities to earn income before age 14, such as:

- Selling candy and other items to classmates

- Mowing lawns or raking leaves

- Tutoring other kids

- Babysitting

- Modeling for marketing materials

- Running a YouTube or TikTok channel

- Blogging about games or hobbies

The key is to generate income from outside the household, expanding the income pie instead of just shifting it around from Bank of Mom & Dad to child. If a child can make money from both external sources and their parents, even better.

Investing As A Child To Become A Millionaire

There are three primary ways a child can invest:

- Roth IRA – Contributions must come from earned income. If a child earns money, opening a Roth IRA is a no-brainer to save on taxes.

- Custodial Investment Account – Funded by both earned income and parental contributions, with parents maintaining control until adulthood.

- 529 College Savings Plan – Contributions usually come from parents or grandparents, but this can still be part of a child’s net worth since education is an asset. Children can also contribute to their 529 plans. Let’s just consider this a bonus for now.

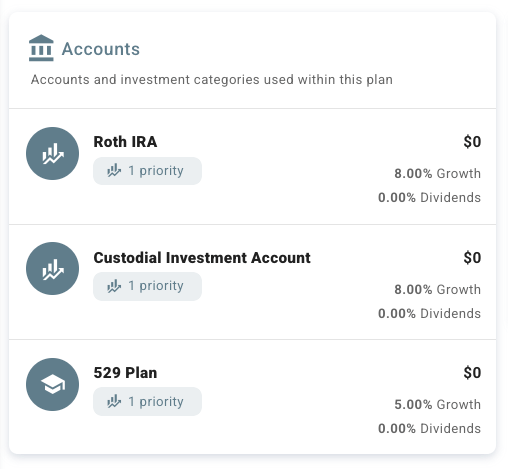

Below we input the assumptions in ProjectionLab.

How Much To Earn and Invest to Become a Millionaire

Let’s calculate how much a child must earn and invest to reach $1 million by ages 18, 22, and 25. 18 is usually the age kids graduate from high school. 22 is usually the earliest a kid graduates from college. And 25 is an age where I’d like the adult child to finally leave home.

Millionaire By 18: Starting At Birth

If a child starts investing from birth, they have the most time for compounding. Here’s how it could work:

- Parents own a business or start a side hustle and legally employ their child for marketing or content creation.

- The child earns enough to max out a Roth IRA at $7,000 annually.

- All additional earnings ($20,000) go into a custodial investment account.

- Parents contribute $36,000 annually to a 529 plan.

- Investments grow at 8% annually for stocks and 5% for the 529 plan.

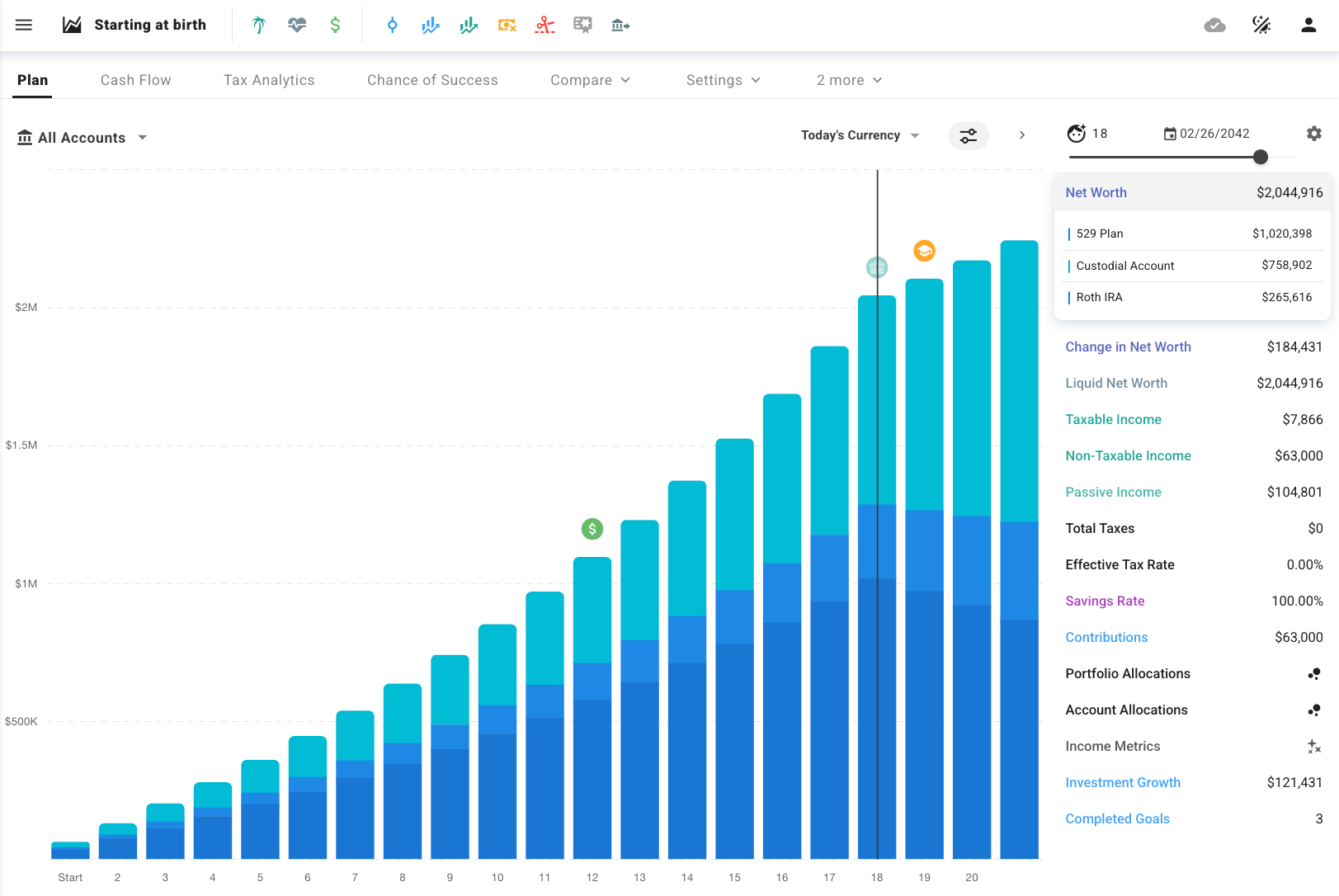

Here’s what the road to millionaire by 18 starting at birth would look like using ProjectionLab:

Projected Net Worth at 18:

- Roth IRA: $7,000/year at 8% for 18 years = ~$265,000

- Custodial Investment Account: $20,000/year at 8% for 18 years = $759,000

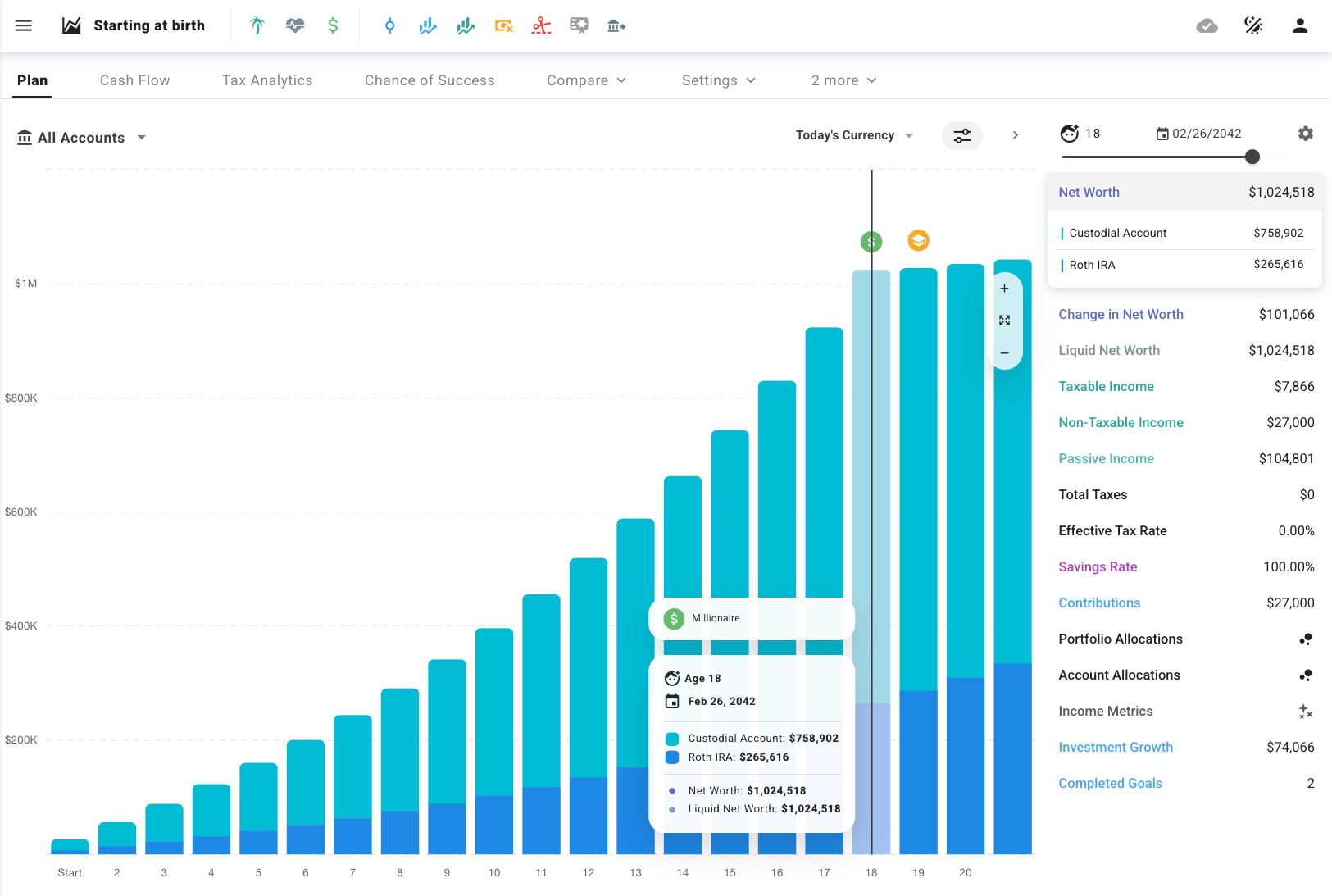

Combined, the child reaches a net worth of $1,024,000. Hooray! All a child has to do as soon as they come out of the womb is earn $27,000 a year for 18 years and earn an 8% compound annual return. But wait, there’s the 529 Plan balance to calculate as well.

- 529 Plan: $36,000/year at 5% for 18 years = ~$1,020,000

Total Net Worth by 18 including the 529 Plan: ~$2,045,000. Any leftover funds in a 529 Plan can be reassigned to another beneficiary, such as future grandkids. Additionally, as of now, up to $35,000 of unused 529 funds can be rolled over into a Roth IRA.

While including a 529 Plan in your child’s net worth is debatable, it remains one of the most tax-efficient ways to transfer wealth across generations. If your children have kids of their own, any remaining 529 funds will be a valuable resource. After all, one of the primary reasons parents work, save, and invest is to fund their children’s education.

Excluding the 529 College Savings plan would look like this:

Millionaire By Age 22 Starting At Age 8 (14 years):

Let’s say making money as a baby is simply out of the question, which for most families, it is. Then how about we assume your child starts at a more reasonable age to make money, at age eight, and works and invests for the next 14 years. My son is eight this year and I definitely plan to put him to work as a Financial Samurai employee. He’ll learn how to edit and update older posts.

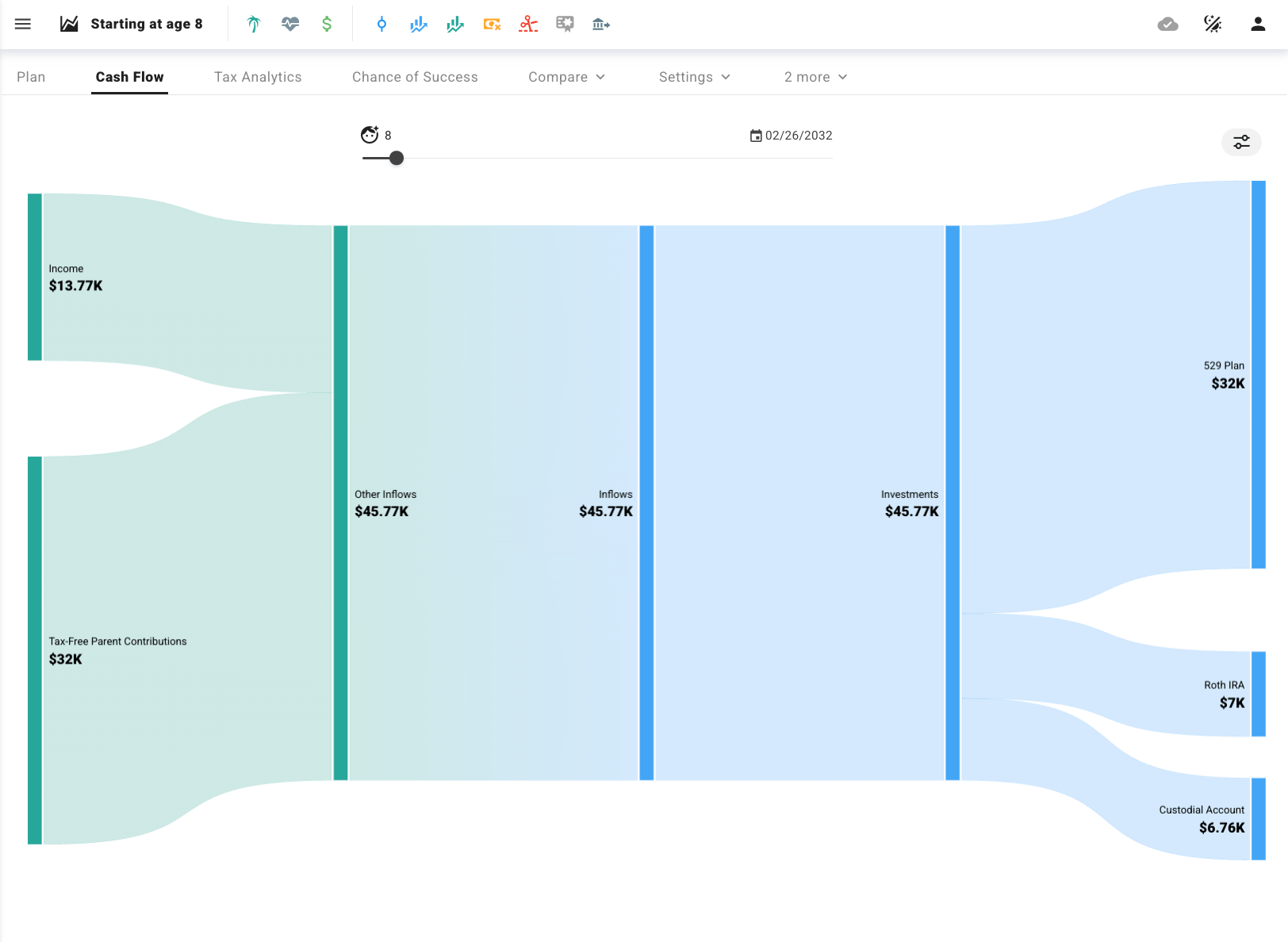

Let’s calculate how much he would need to earn, invest, and return to get to $1 million by age 22 starting at 14. Below are the various assumptions I’ve plugged into ProjectionLab.

- Roth IRA: $7,000/year average at 8%: $186,000

- Custodial Account: $6,765/year at 8%: $179,000

- 529 Plan: $32,000/year at 5%: $663,000

- Total: ~$1,029,000

- Annual Contribution: $45,785

Earning and investing $13,765 a year on average for 14 years seems completely reasonable. A child would need to work for 13.3 hours a week at $20 an hour to get to $13,765 a year. I think this is highly feasible, especially given the minimum wage should go up over this time period. But this would only get the child to a net worth of $365,000 at age 22. Not bad, but no millionaire.

If we exclude the 529 Plan, then the child would have to increase their annual saving and investing amount from $13,765 to $45,785 to become a millionaire by 22 all by themselves. That sounds difficult to do as a full-time student. However, there are plenty of ways to make money online now that could easily surpass $45,785 a year. We’ll see how in the section below.

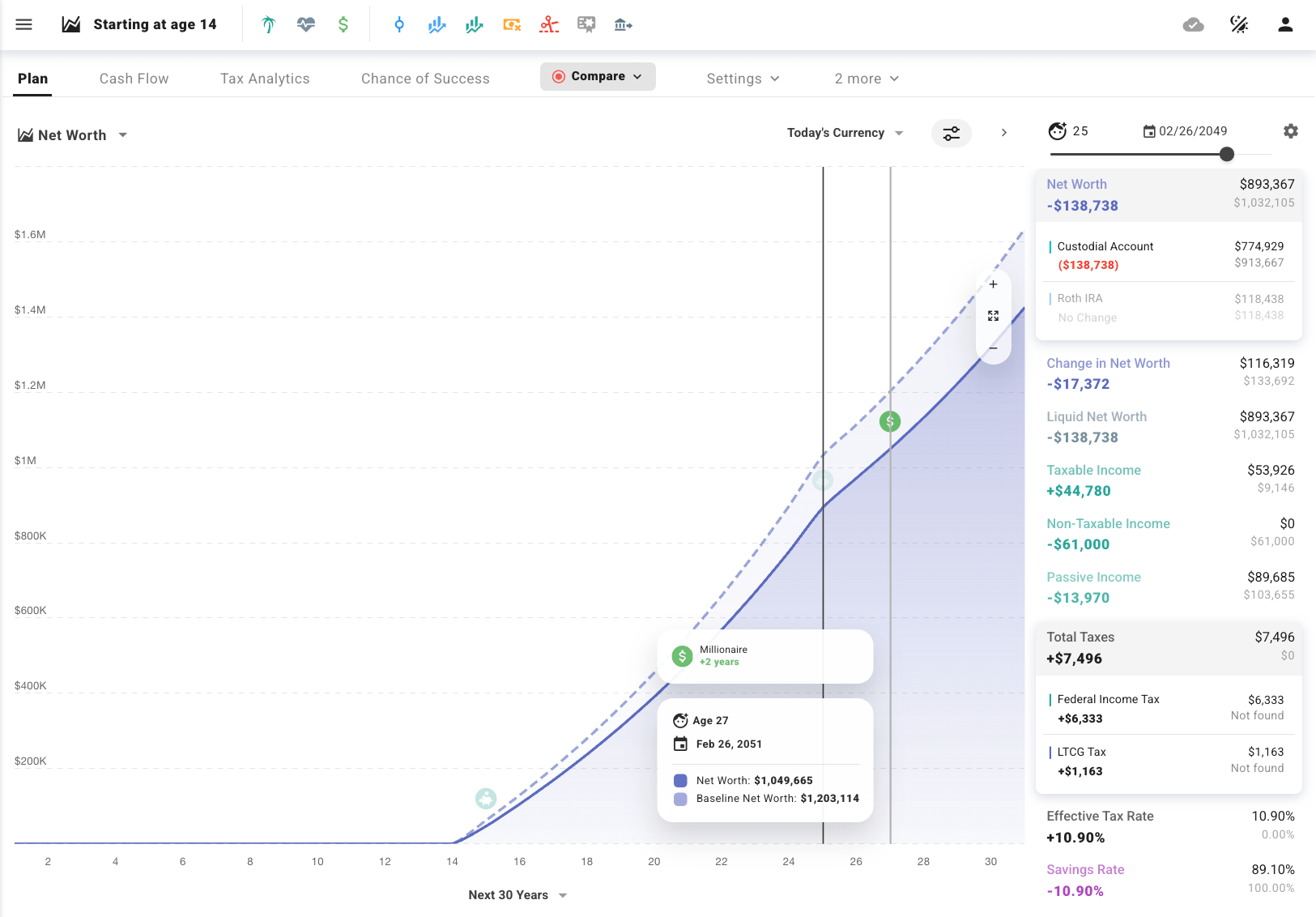

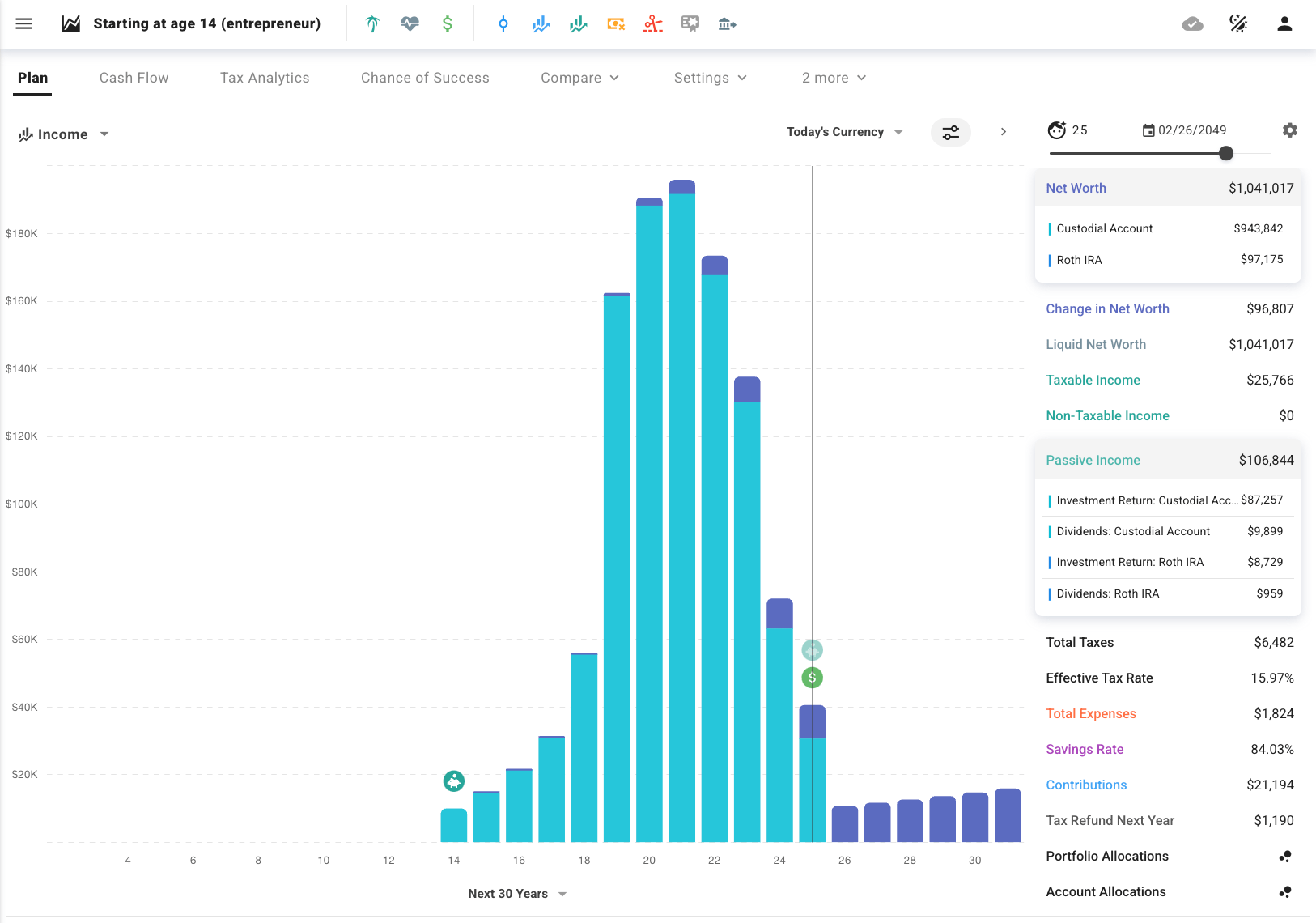

Millionaire By 25: Starting At Age 14 Without Parental Contribution

If making your kid work at eight still sounds too extreme, let’s start at age 14 and continue until age 25. By starting at 14, a child can become a millionaire by age 25 without parental contributions if:

- Child earns: $61,000/year

- Roth IRA: $7,000/year at 8% for 11 years → ~$118,000

- Custodial Account: $54,000/year at 8% for 11 years → ~$914,000

- Total Net Worth by 25: ~$1,032,000

- Requirement: The child must generate $61,000 in annual earned income (e.g., through a successful online business, content creation, or rare talent).

However, that’s after taxes. After years of paying Uncle Sam, your kid would actually have $139K less in their custodial account—meaning they’d need to work two more years or earn closer to $70K per year to reach millionaire status.

Alternatively, The Bank of Mom & Dad can simply make up the difference. If your child starts diligently working at age 14 for 11 years and does something entrepreneurial, it would be hard for a parent not to help out in some way. That’s quite a responsible child!

How To Earn $61,000 A Year Starting As A Teenager

Earning $61,000 a year after taxes from age 14 to 25 (an 11-year span) is a lofty goal for a teenager, especially starting with no prior income or experience. This averages out to about $5,083 per month or roughly $1,250 per week.

For context, that’s well above the U.S. federal minimum wage for full-time work ($7.25/hour, or $15,080/year for 40 hours/week). Further, teens face legal restrictions on hours and job types, plus the demands of school. Still, it’s not impossible with exceptional effort, creativity, and some luck.

Here are realistic ways a child could work toward that income level, assuming they sustain it annually from 14 to 25. Please remember that I’ve been technically making money online since 2009, so I have a deep understanding of how to do so.

1. Start a Scalable Online Business

- What: Launch a business like dropshipping, print-on-demand (e.g., t-shirts, mugs), or digital product sales (e.g., eBooks, templates) via platforms like Shopify, Etsy, or Gumroad.

- How: At 14, they could begin with a low-cost niche (e.g., gaming merchandise or study guides for peers), reinvesting profits to scale. By 16–17, with a strong social media presence (TikTok, Instagram, YouTube), they could drive serious traffic.

- Earnings Potential: Early years might net $5,000–$10,000 annually, but by 18–25, a well-run operation could hit $61,000/year with consistent growth and marketing savvy.

- Realism: Requires learning digital marketing and some upfront cash (e.g., $500–$1,000), but teens like Isabella Barrett (millionaire by 6 via jewelry) show kids can scale businesses young.

2. Content Creation (YouTube, Twitch, TikTok)

- What: Create videos or streams—gaming, tutorials, vlogs, or niche hobbies—monetized via ads, sponsorships, and merch.

- How: Start at 14 with a parent-managed account (YouTube requires 13+, Twitch 13+ with supervision). Build a following over years; monetization kicks in with 1,000 subscribers and 4,000 watch hours (YouTube) or 50 followers and consistent streaming (Twitch).

- Earnings Potential: Top earners like Ryan Kaji ($30M/year at 9) are outliers, but $61,000/year is doable by 18–25 with 50,000–100,000 followers and multiple revenue streams (ads: $3–$5/1,000 views, plus deals).

- Realism: Takes 2–3 years to gain traction, plus editing skills and persistence. Many teens abandon this early, but those who stick with trends (e.g., short-form content) can break through.

Or maybe they burn out or face an algorithm change that drastically cuts their income—something that happens all the time in the online world, especially now that AI is reshaping industries. Even after grinding through school and going full-time post-graduation, income isn’t always guaranteed to last.

With ProjectionLab, I can model out different scenarios, including potential income drop-offs. But by the time that happens, the child is already a millionaire, thanks to smart earning, investing, and compounding. Running these projections helps ensure financial security, no matter what life throws their way.

3. Freelancing High-Value Skills

- What: Offer services like graphic design, coding, video editing, or writing on platforms like Fiverr or Upwork.

- How: At 14, learn skills via free resources (YouTube, Codecademy). By 15–16, take small gigs ($10–$20/hour), building a portfolio. By 18, charge $50–$100/hour for specialized work (e.g., app development).

- Earnings Potential: $61,000/year means ~1,220 hours at $50/hour—about 23 hours/week. Teens could hit this by 17–18 with hustle and skill.

- Realism: Requires self-taught expertise and client trust (harder as a minor), but teens like Stanley Tang (DoorDash co-founder at 20) prove young talent can earn big.

4. Competitive Gaming or Esports

- What: Compete in games like Fortnite, Valorant, or League of Legends, earning prize money and sponsorships.

- How: Start at 14 practicing 20–30 hours/week, joining amateur tournaments (e.g., via Battlefy). By 16–17, aim for pro qualifiers or streaming revenue.

- Earnings Potential: Top players earn millions, but mid-tier pros can make $50,000–$100,000/year by 18–25 via winnings and deals.

- Realism: Needs elite skill (top 1% of players) and parental support for travel. Most don’t make it, but dedication can pay off—e.g., Kyle Giersdorf won $3M at 16 in Fortnite. If you become a top player, you can then create content on YouTube and monetize your content since you have authority. Just know that all this screen time at a young age may not be good for kids.

5. Teen Entrepreneur with Local Services

- What: Run a service like lawn care, car washing, or tutoring, expanding to a small crew by 16–17.

- How: At 14, charge $20–$30/job in the neighborhood (legal under FLSA exemptions for self-employment). By 16, hire friends, scale to $100–$200/day.

- Earnings Potential: 10 lawns/week at $30 = $15,600/year initially; scaled to 20 jobs/week at $50 = $52,000/year by 18, plus extra summer work to hit $61,000.

- Realism: Doable with hustle and word-of-mouth, though limited by school hours (max 18 hours/week during terms for 14–15-year-olds).

6. Investing In The Stock Market And Other Risk Assets

- What: Invest earnings in the S&P 500, growth stocks, or even crypto via a custodial account, aiming for high returns.

- How: At 14, use income from chores or small gigs ($5,000/year) to invest via a parent-managed account. Focus on growth stocks or volatile assets (e.g., Bitcoin), that have the potential to compound at an even higher rate than the S&P 500.

- Earnings Potential: $5,000/year at 15% average return over 11 years = ~$163,000 total, but active trading could push annual gains to $61,000 by 20–25.

- Realism: Risky with a higher probability of losing money. Requires financial literacy and luck. Most active traders underperform the S&P 500 or index of their choice. However, you can get lucky. I invested $3,000 in a Chinese internet company called VCSY in early 2000 and it went up 50X. So you never know unless you try.

Putting It Together To Become Millionaire By 25

A realistic path might combine these:

- Ages 14–16: Start with freelancing ($10,000/year) and content creation (building audience).

- Ages 17–19: Scale freelancing to $30,000/year, monetize content for $20,000/year, add local services ($15,000/year).

- Ages 20–25: Hit $61,000/year consistently as skills, audience, and business mature.

Of course, this path won’t be easy—but nothing worthwhile ever is! More importantly, nothing happens if the teenager doesn’t start. As parents, we should do everything we can to teach, encourage, and support them, all while ensuring they stay on top of their schoolwork. The earlier they begin, the greater their financial advantage will be.

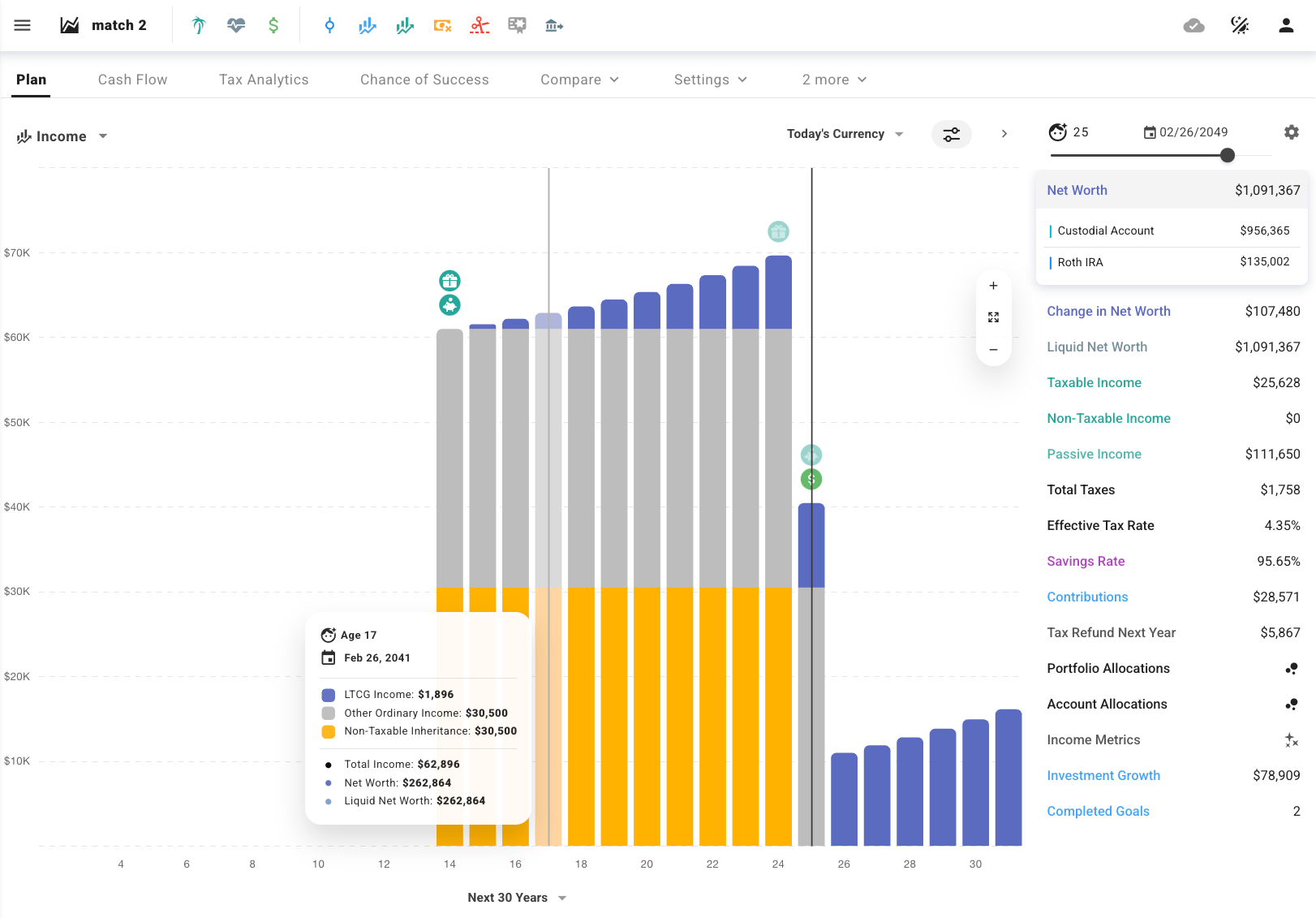

Parental Financial Match: A Likely Necessity

To make it easier for their children to reach a million dollars by the time they are adults, parents can implement a parental match, similar to how companies match 401(k) contributions to encourage savings. A reasonable match could range from 20% to 100% of what the child earns. However, exceeding a 100% match may diminish the child’s sense of pride in earning money independently.

For example, if a child needs to earn $61,000 per year on average from age 14 to 25 to reach millionaire status, a 100% parental match would reduce their required earnings to $30,500 annually. However, parents should be mindful of tax implications when gifting amounts above the gift tax exclusion, which is $19,000 per parent or $38,000 per married couple per child.

The Ideal Parental Financial Match For Their Kids

Personally, I believe matching up to the annual gift tax exclusion is a great strategy, especially if you anticipate your estate growing beyond the estate tax threshold ($13.99 million per person). This approach encourages the child to earn at least up to the gift tax limit, fostering both financial responsibility and motivation. If they aspire to earn more, the rest is up to them.

By having parents contribute, it creates buy-in from them as well. This involvement encourages parents to share their financial wisdom, helping their children develop a stronger understanding of wealth-building. As a result, children are more likely to take their finances seriously and make smarter financial decisions in the future.

Final Thoughts on Making Your Child a Millionaire

Becoming a millionaire by age 25—let alone 18—isn’t easy, but with the right combination of earning, investing, and compounding, it’s achievable. It’s far more realistic to help your child build wealth than to expect them to earn straight A’s, score a 1,590 on the SAT, and still face rejection from top colleges.

Even if they fall short of the millionaire mark by 18, 22, or 25, they’ll still have significant financial security and strong personal finance fundamentals to guide them through life.

Parents play a crucial role in this journey by sharing financial knowledge and expanding opportunities beyond the traditional 9-to-5 path. The more we understand how money is made and grown, the more we can pass those lessons on, fostering an entrepreneurial mindset that can pay dividends for generations.

The world will never be perfectly fair. But that doesn’t mean we shouldn’t try our best, even when the odds are stacked against us. As a Financial Samurai, you don’t complain—you take action! A strong financial foundation gives us the power to navigate challenges with confidence and independence.

Imagine This Dream Scenario for Parents

Imagine this plan in action. With the right mix of parental support, hard work, and smart financial decisions, your child becomes a millionaire by 18, buys a duplex at 21, upgrades to a single-family home at 27, and reaches a $2.5 million net worth by 30.

Thanks to their financial security, they are generous, grounded, and able to pursue a meaningful career. While working to save the rainforest—and rescuing baby pandas along the way—they meet another nature lover. One thing leads to another, and they fall in love, get married, and start a family years later.

As parents, you feel immense satisfaction knowing you gave your child the foundation for a fulfilling life. Then, as grandparents, you experience another layer of joy. And when your time comes, you leave this world at peace, knowing your family is secure—all thanks to a little financial planning early on.

Priceless

To help you and your child visualize and plan this journey, I highly recommend ProjectionLab. With its powerful financial modeling tools, you can create detailed, personalized projections for net worth growth, investment strategies, and financial milestones.

Whether you’re mapping out their path to becoming a millionaire or fine-tuning your own financial independence plan, ProjectionLab makes it easy to test different scenarios and optimize your strategy.

Reader Questions

What are your thoughts on helping your children become millionaires before they leave home? If done right, wouldn’t this set them up for a much happier and more secure future? On the flip side, could teaching kids about hard work, investing, and money management too early have unintended downsides?

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009. Everything is written based on firsthand experience and expertise. I use ProjectionLab and it is a Financial Samurai affiliate.

Read the full article here