WAYHOME studio/Shutterstock

Key takeaways

- Credit card security codes are three-digit codes on the back of your card (four-digits on the front if you have an American Express card) used to verify that have the physical card.

- You typically won’t have to provide your security code (also known as a CVC) unless you’re paying for something online or over the phone.

- Merchants aren’t allowed to store security codes, which is another factor that makes credit cards one of the safest ways to pay for purchases.

If you’ve ever purchased anything online or over the phone and paid with a credit card, you more likely than not have been asked for your card’s security code. This is a short series of digits found on your physical card that’s different from your credit card number. Providing this code gives some extra security that the card is in your possession and that your payment information isn’t being used fraudulently.

What is a credit card security code on a credit card?

A credit card security code is a three- or four-digit code that’s unique to your card. In case a merchant asks, the security code goes by a few different names, mainly the:

- Card Verification Value number (CVV)

- Card Verification Code number (CVC)

- Card Identification number (CID)

This number is printed on your card and can’t be found through your online credit card account or on any of your credit card documents. Because this security code is located only on your physical card, merchants may ask for the CVC when you pay online or over the phone to verify that you own the card.

To be safe, though, merchants aren’t allowed to store credit card security codes after they complete transactions. So while thieves might be able to steal credit card numbers if they hack into a retailer’s electronic records, they shouldn’t be able to access the security codes.

Why credit card security codes are important

Security codes provide an extra layer of protection in keeping your credit card information private. As we mentioned previously, merchants are prohibited from storing personal CVV data. So if you are asked to verify your security code, the merchant is simply working to ensure you have the card in hand. Because this data is never stored, falling victim to fraud is more difficult, although not impossible if the merchant is hacked or someone writes down your card information. However, you can rest a bit easier since credit cards are still the safest way to pay.

How to find your security code

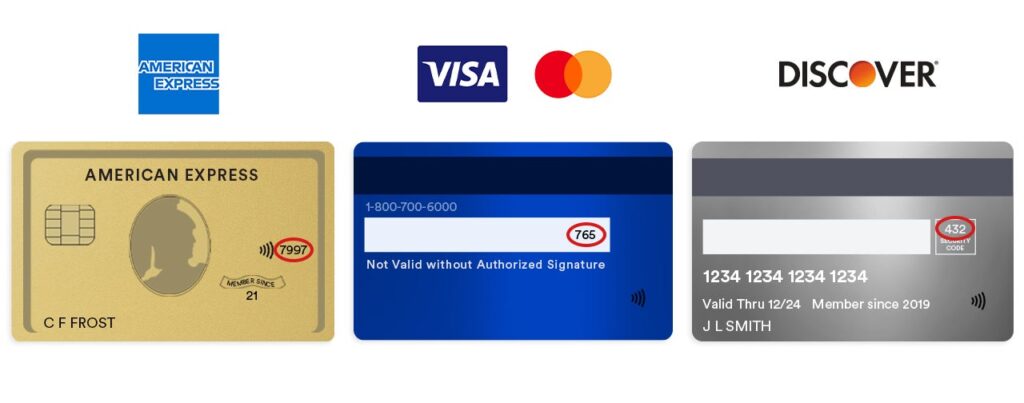

Here’s where you can usually find your credit card’s security code, depending on which network your card is in. The layout can vary a little by issuer and card, though, so in the event you don’t see the code where you thought it would be, keep looking for an unembossed three- or four-digit number.

- American Express: Four digits on the front of the card, on the right-hand side above the card number

- Mastercard and Visa: Three digits on the back of the card at the right end of the signature field

- Discover: Three digits on the back of the card, inside a box to the right of the signature field

When do you need your card’s security code?

You often will need your credit card security code when you buy something online or by phone. Not every merchant asks for the code in these cases, but many require it for additional security.

You also generally need the security code the initial time you provide your credit card information on a mobile payment app like Apple Pay or Google Pay, but you don’t need to give the code every time you pay for something with a digital wallet.

You don’t need to enter your security code when you pay in person at a card terminal. And if you give a retailer permission to keep your card information on file and to charge future purchases to your card, you don’t have to manually provide the security code for each following transaction.

How to keep your card information secure

Considering Bankrate’s 2024 holiday spending report showed nearly 1 in 4 people made social media-influenced impulse purchases, protecting your credit card information against potentially shady merchants online is as important as ever. Requiring customers to give their credit card security codes when they make a purchase can protect against fraud, but the codes must be known only to cardholders for this security feature to work. Here are a few tips to guard your credit card information:

- Paying with a digital wallet, your card’s chip and PIN method or a virtual credit card number can add an extra safety net if your data is exposed to skimmers or cybercriminals.

- Don’t give your credit card to other people or leave it in a public place.

- Verify that websites are secure before shopping online. Check that the website address begins with “https” and that a lock icon appears next to the URL.

- Don’t enter credit card information at a public computer or over public Wi-Fi networks.

- Don’t give out credit card information to anyone who’s called you on the phone — even if the caller ID looks right. Those who scam can manipulate caller ID. If you want to pay for something by phone, it’s recommended that should call the merchant yourself.

- Make sure your card isn’t visible in any photos you post online.

- If you store credit card information on your phone, set your phone to lock promptly when not in use, and protect it with a strong passcode or biometric authentication.

- Take advantage of any security services your credit card issuer offers, such as credit monitoring and account alerts for unusually large transactions or suspicious account activity.

- If you believe your account information may have been compromised, tell your card issuer right away so it can send you a new card.

Frequently asked questions

The bottom line

Credit card security codes (often called CVCs or CVVs) are a simple, additional measure to keep your card safe against unauthorized users. If you’re using your card online or over the phone, merchants typically ask for your security code to verify that you physically have the card so that someone who has taken your other credit card information can’t make a purchase.

Granted, security codes aren’t as effective of a protection as features like contact tap payments or digital wallet payments, but CVCs are an extra layer of defense for your credit card.

Read the full article here