You know the old saying, “What you don’t know can’t hurt you”? Well, that’s a bunch of bull—especially when it comes to Social Security.

Most folks think their monthly retirement benefit will be much more than what they’ll actually get. But here’s the good news, Americans are starting to wake up. In fact, while 62% of current retirees report Social Security as a major source of income, only 35% of today’s workers expect the same when they reitre.1

These 35% of folks are going to learn the hard way that what they don’t know can and definitely will hurt them when they retire. Don’t let that be you!

Your financial security in retirement shouldn’t come from Social Security—it should come from what you’ve saved over your working lifetime. You are the CEO of your retirement.

Let’s dive into those big questions so you can have a realistic picture of how they might play a role in your retirement planning.

- What Are Social Security Benefits?

- How Do Social Security Benefits Work?

- Do I Qualify for Social Security Benefits?

- What Is the Average Social Security Benefit?

- What Will Social Security Be Like When I Retire?

- When Should I Start Receiving Social Security Benefits?

- Do I Have to Pay Taxes on My Social Security Benefits?

1. What Are Social Security Benefits?

Let’s talk definitions first. Social Security benefits are simply payments made to you when you retire or become disabled. These payments are designed to help replace some of the income folks lose when they retire or can’t work anymore because of a disability. Benefits could also be paid to your spouse, children and other qualifying family members when you die.

There are three types of Social Security benefits you need to know about.

Retirement Benefits

Social Security will replace a chunk of the income you made throughout your career based on your lifetime earnings. We’re going to focus mostly on these benefits, but first let’s talk about the other two types.

Disability Benefits

Did you know that, sadly, more than 1 in 4 20-year-olds today will become disabled before they reach retirement?2 If you have a medical condition that’s expected to keep you from working for at least a year or could potentially lead to your death, disability benefits can help you get through that difficult time.

As of August 2024, there are currently about 7.3 million disabled workers receiving an average monthly payment of $1,540 in disability benefits from Social Security.3

Survivors Benefits

We know talking about death isn’t going to win you any friends at a party. But we have to talk about this stuff. Your spouse, children and other family members might qualify for survivor benefits that can replace some of your family’s lost income if you die.

Market chaos, inflation, your future—work with a pro to navigate this stuff.

We hope your family is never in this position, but it’s comforting to know that your loved ones will have some money coming in if the unthinkable happens. Right now, almost 6 million people are receiving an average monthly survivor benefit of $1,510.4

Now that you know all the different types of benefits, let’s break down how all this stuff works.

2. How Do Social Security Benefits Work?

Social Security is funded by FICA taxes (and self-employment taxes) paid by hardworking American workers like you.

In 2024, the Social Security tax rate is 12.4%. If you work for someone else, you and your employer split the bill, paying 6.2% each, and it’s taken straight out of your paycheck before you ever see it. If you’re self-employed, you’re on the hook for the entire 12.4%, but you can claim the “employer” half of the tax as a tax deduction.5,6

For high-income earners, there’s a limit on how much of your income is subject to the Social Security tax. For 2024, you won’t pay Social Security taxes on any income above $168,600.7

Now listen, it’s important to remember that these taxes are not used to pay for your future benefits. Instead, those payroll taxes you’re paying are collected by the IRS and sent out to folks who are currently receiving Social Security benefits (those folks are also called beneficiaries).

Today, the taxes you and about two other workers pay (2.7 workers to be exact) cover the benefits for one Social Security beneficiary. And it’s only going to get worse: By 2035, there’ll be only 2.4 workers for each beneficiary—but the number of beneficiaries will jump from 61 million to 77 million.8 Uh-oh. Now you can see why the math on Social Security makes a lot of folks nervous.

3. Do I Qualify for Social Security Benefits?

So what about your benefits? If Social Security is still around when you retire, your benefits will be paid for by folks who are still working. But first, you’ve got to qualify to receive retirement benefits. You do that by working and paying those Social Security taxes, which helps you earn Social Security “credits.”

To get retirement benefits through Social Security, you have to earn at least 40 credits over your working lifetime.9 Don’t worry, it’s not that hard to do!

In 2024, you can earn a credit for every $1,730 you make, and you can earn up to four credits each year. So, if you earn at least $6,920 this year and you paid Social Security taxes on that income, congratulations! You’ve earned the maximum four credits for the year.

After 10 years of work, most workers have earned all the credits they need to receive full retirement benefits once they reach retirement age (more on that later). Do you know what that means? It’s time to get to work!

4. What Is the Average Social Security Benefit?

According to the Social Security Administration, the estimated average monthly retirement benefit in 2024 will be $1,907.10 That adds up to around $22,900 each year. No matter how you slice it, that’s not a lot to live on.

Among the elderly, 12% of men and 15% of women rely on Social Security for 90% or more of their income.11 Folks, these payments were always meant to replace some of your income in retirement—not all of it.

If you’re still working, it’s up to you to secure your retirement future. If you’re out of debt and have emergency savings in place, it’s time to start saving 15% of your income for retirement.

Your 401(k) and Roth IRA should be the foundation of your retirement plan and your main source of income in retirement—not Social Security. If you feel behind, there’s still time to get back in the game. It’s never too late! Working with an investment professional like a SmartVestor Pro can help you get the ball rolling on your retirement dreams.

And now for the question that’s on the mind of most of America’s current workforce . . .

5. What Will Social Security Be Like When I Retire?

Like we mentioned earlier, as more and more boomers retire, the number of Americans 65 and older is expected to jump from roughly 61 million today to about 77 million in 2035. At the same time, there will be fewer workers supporting more retirees, which puts even more of a strain on the system.12

The year 2035 is shaping up to be a big year for Social Security for an even bigger reason: That’s the year Social Security’s trust fund reserves are expected to run out of money if nothing changes.13 Depending on what Congress does (or doesn’t do), future retirees might need to prepare for the possibility of reduced benefits, and workers might see a hike in Social Security taxes.

What’s the bottom line here? We can’t depend on Washington to take care of us in retirement. Do you really want to put your retirement dreams in the hands of the government? Heck no!

If you end up getting retirement benefits when you decide to retire, that’s great. Any money you get from Social Security should be considered icing on the cake. But making Social Security the main ingredient of your retirement plan? That’s a recipe for disaster.

6. When Should I Start Receiving Social Security Benefits?

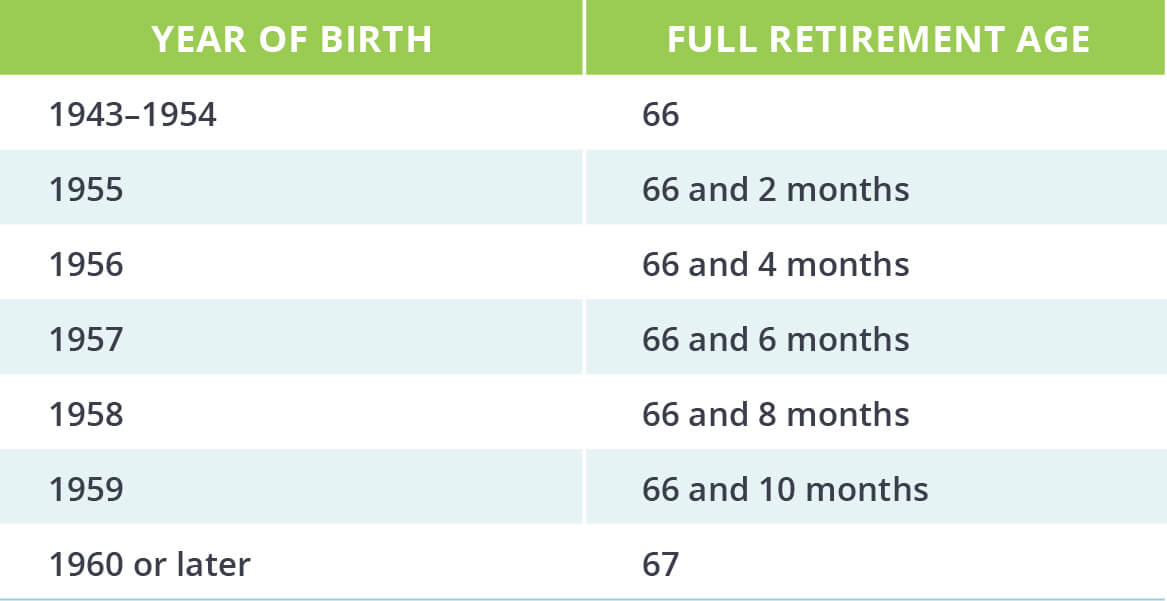

You’re eligible to start receiving retirement benefits at age 62 (even if you choose to keep working), but you won’t be able to receive your full retirement benefits until you hit your full retirement age, which is based on when you were born. If you were born in 1960 or later, for example, your full retirement age is 67.14

The big question most folks have when they first become eligible to receive Social Security retirement benefits is whether to start receiving the reduced benefit right away or wait until full retirement age (or later) to get a larger monthly benefit. It’s a big decision—because once you start receiving your benefits, there’s no going back.

In most cases, it actually makes more sense to take your retirement benefits sooner instead of waiting later. Why? Because your retirement payments die when you die . . . so you might as well take the money and make the most of it while you can.

If you don’t need to rely on Social Security benefits to make ends meet in retirement, we especially like the idea of investing the money you get from those monthly payments and beefing up your nest egg in the process. After all, you can do a much better job investing that money than the government ever could.

Plus, taking your benefits early means you’ll receive payments for a longer period of time during retirement. And depending on how long you live, you could end up receiving less money over the course of your retirement from Social Security the longer you wait.

For example, let’s say your full retirement benefit is a monthly payment of $1,500 and your full retirement age is 67. If you decide to take your benefit at age 62, you’ll only get 70% of your full retirement benefit, which comes out to $1,050 each month.15 On the flip side, if you’re really patient and wait until you turned 70 years old to claim your retirement benefits, that would bump your monthly Social Security income up to $1,860 (that’s 124% of your full retirement benefit).16

If you passed away at 77 1/2 years old (which is the average life expectancy in the U.S.), you’d end up with more Social Security retirement benefits if you started taking money out at age 62 instead of waiting for a larger monthly payment:17

|

WHEN IS THE BEST AGE TO CLAIM SOCIAL SECURITY? |

|||

|

Age You Choose to Start Receiving Benefits |

Monthly Retirement Benefit Amount* |

Length of Retirement** |

Total Social Security Retirement Benefits |

|

62 |

$1,050 |

15 years |

$189,000 |

|

67 |

$1,500 |

10 years |

$180,000 |

|

70 |

$1,860 |

7 years |

$156,240 |

*Based on full retirement age benefit of $1,500 at age 67.

**Based on CDC’s average life expectancy of 77 years.

Like we said, this is a big decision, so you should talk with your financial advisor before you make the final call.

7. Do I Have to Pay Taxes on My Social Security Benefits?

Like a lot of things that have to do with taxes, it depends. Chances are you might have to pay at least some income taxes on your retirement benefits from Social Security based on your combined income (that’s your taxable income plus half of your Social Security benefits) and filing status.

The good news is that not all of the money you get from Social Security will be taxed. No one will pay taxes on more than 85% of their retirement benefits. Thanks, Uncle Sam!

If you’re receiving Social Security retirement benefits this year, here’s how it works:

- If you’re single: You’ll pay income tax on up to 50% of your benefits if your combined income this year is between $25,000 and $34,000. But if you bring in more than $34,000, up to 85% of your benefits will be taxed.

- If you’re married filing jointly: If you and your spouse have a combined income between $32,000 and $44,000, you’ll also pay income tax on up to 50% of your benefits. Once you’re above that $44,000 combined income level, up to 85% of your benefits will be taxed.18

As the politicians in Washington debate over what to do about Social Security in the future, these tax rates might change—so keep your eyes open!

Look, taxes are already confusing enough—and Social Security benefits only complicate things more. It’s probably a good idea to reach out to a tax professional who can help you figure out how your benefits will impact your tax bill.

Get Ready for Retirement

No matter how much or how little you expect to receive from Social Security, you need to start saving for retirement right now. Retirement isn’t an old people thing. It’s a smart people thing.

That’s why we recommend working with an investment professional through our SmartVestor program. They’ll sit down to help you figure out how Social Security fits into your retirement strategy and help you come up with a plan to reach your retirement goals.

Read the full article here