As savers, we are being rewarded with higher risk-free yields. Treasury bills (T-bills), Treasury bonds, and money market funds are still paying over 4% without taking equity or credit risk. Because Treasury interest is exempt from state income tax, these instruments are especially attractive for higher earners in high-tax states like California and New York.

In my taxable portfolio, I hold mostly Treasury bills (maturity under one year), followed by a handful of Treasury bonds. I also keep a small amount in my Fidelity SPAXX money market fund at any given time. Since 1999, my goal has been to invest as much of my capital as possible in risk assets while keeping cash levels lean. Having little-to-no cash makes me feel like I’m living paycheck to paycheck, which helps sustain discipline for not buying wasteful things.

In the old days, when cash yielded less than 1%, not having cash was easy. But as my exposure to venture capital and venture debt funds grew, I needed to set aside more liquid capital for capital calls. When a capital call goes out, I usually only have two weeks at most to come up with the cash.

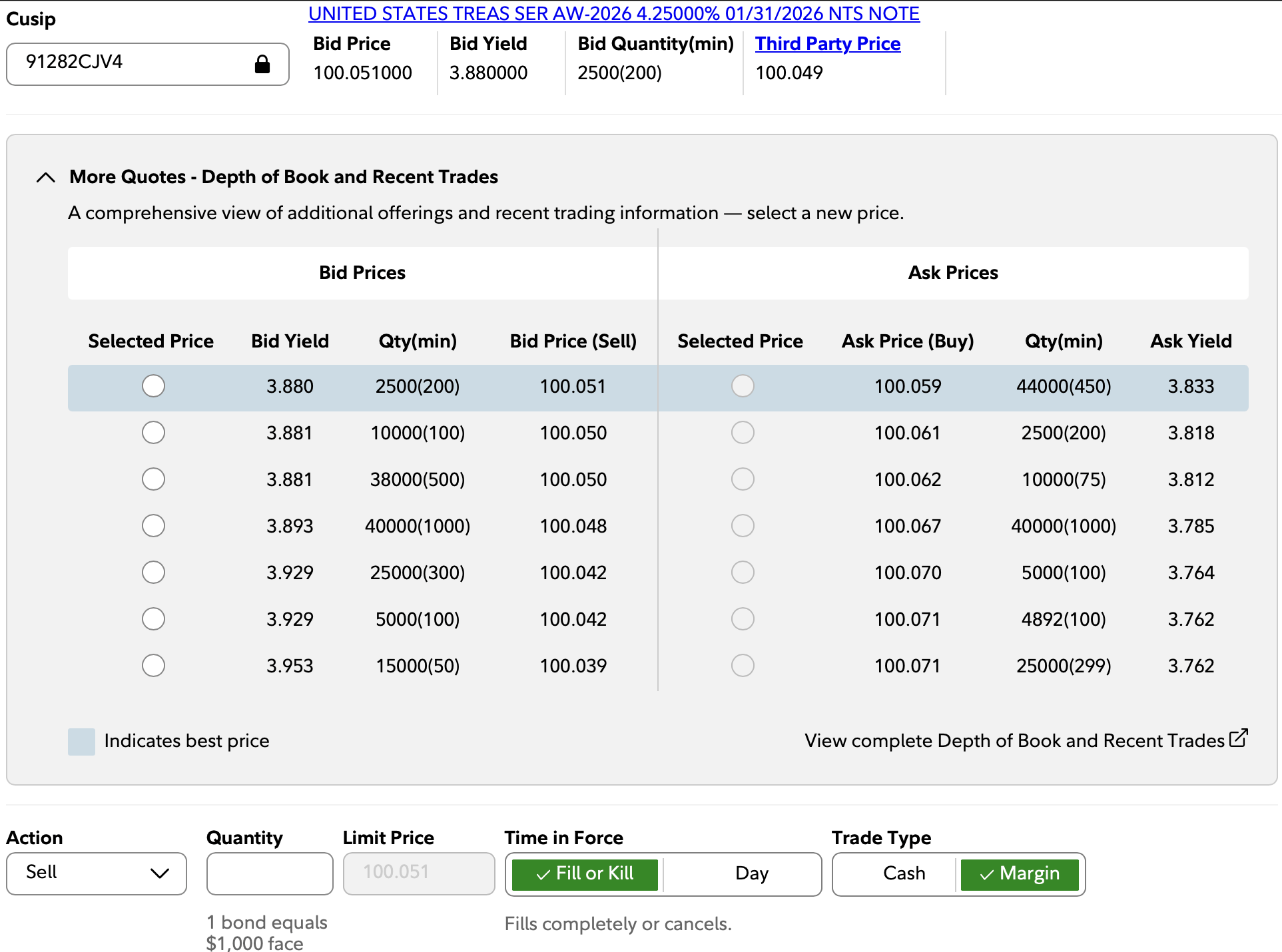

On the bright side, selling Treasuries to raise cash, whether to fund a capital call, pay property taxes, or buy a stock market dip, is extremely easy and liquid. You don’t have to worry about getting stuck holding your Treasury bonds to maturity, given how liquid the Treasury bond market is.

However, something I didn’t fully appreciate until recently selling about $110,000 worth of Treasuries is this:

Selling Treasury bonds can trigger state-taxable capital gains, even though interest is exempt.

Selling Treasury Bonds To Buy Stocks Is Easy

Ideally, you want to hold all your Treasury bonds to maturity to eliminate investment risk and minimize state income taxes. If you hold to maturity, you receive 100% of your principal back plus the stated interest. And if you bought the Treasury at a discount, you’ll get par value ($100) at maturity, locking in the yield you originally expected.

However, because my wife and I are jobless, we don’t have a steady stream of cash flow to meet capital calls or buy meaningful amounts of stock each month. As a result, we’re often forced to sell Treasury bills or bonds to fund investments, while still staying within our overall asset allocation plan.

If you want to FIRE, be prepared for one frustrating downside: missing out on the ability to buy stocks with a big paycheck during a bull market. Sitting on the sidelines without fresh capital to deploy is never ideal when asset prices keep marching higher.

Below are some of the Treasury bill sales I made between November 17, 2025 and December 1, 2025 to buy stocks, pay property taxes, and cover a surprise $20,000 capital call for a closed-end venture capital fund.

Tax Implications When Selling Treasury Bonds

I hold multiple types of Treasury bonds in my taxable portfolio, so my initial instinct was as follows: First, sell the Treasuries with the nearest maturities. Second, sell the ones with the lowest coupon rates. And finally, only sell positions showing a capital gain. If a Treasury was showing a loss, I figured I would simply hold it to maturity and lock in the guaranteed win. I hate losing money, especially on risk-free assets.

This decision-making framework is logical on the surface. But after thinking deeper, I realized that selling Treasuries has nuances – especially because Treasury interest is exempt from state income tax, while capital gains are fully taxable.

In particular, it’s worth analyzing what happens when you sell a zero-coupon Treasury bill before it matures versus selling a coupon-paying Treasury bill early. Both scenarios carry different tax treatments and potential downsides.

Below is an overview of the considerations and tax implications for the various types of Treasuries I sold.

A Tax-Efficient Guide to Selling Treasuries Before Maturity

The big distinction is this: interest from Treasuries is state-tax-free, but capital gains from selling them early are fully taxable.

Understanding when and what to sell can help you raise cash without giving away avoidable tax dollars.

Zero-Coupon Treasury Bills

Zero-coupon bills are the cleanest structure: you buy at a discount and receive par at maturity. If you hold to maturity, the entire return is treated as interest and remains exempt from California tax. That makes zeros incredibly tax-efficient, if you don’t touch them.

Selling early, however, flips the tax treatment. What would have been state-exempt interest becomes a state-taxable capital gain, erasing the main benefit of owning zeros. They also fluctuate more than coupon bills of the same maturity because they’re pure duration, so you may be selling during a period of volatility and giving up a yield you’ve already locked in.

For most investors, zeros are best treated as “hold-to-maturity” positions. If you need liquidity, you’re usually better off selling other Treasuries with small gains or losses first.

Coupon-Paying Treasuries

Coupon bills and notes are more forgiving when sold early. Their interest remains state-tax-exempt, and their price movements tend to be smaller, which means any gain from selling early is typically modest. That’s useful when you need liquidity for capital calls, want to rotate into risk assets, or hope to realize gains in a lower-income year.

The downside is the same: any capital gain is taxable by your state. If you happen to own a high-coupon bond purchased when rates were low, it may carry an embedded gain that’s expensive to realize. Realize that Treasury bonds can appreciate in value too, as interest rates come down. But shorter-dated or near-par coupon Treasuries generally allow you to raise cash with minimal tax drag.

If you want to avoid state capital gains tax, simply hold your coupon-paying Treasuries to maturity. Both the interest and any price appreciation are treated as interest income, and therefore exempt from state income tax.

Longer-Dated Treasury Bonds (5, 10, 20+ years)

Longer maturities behave like coupon Treasuries but with more rate sensitivity. When sold early, they can produce meaningful gains, or losses. That volatility is actually useful: loss harvesting from Treasuries is tax-efficient because those losses can offset gains elsewhere while avoiding state tax entirely.

If you’re looking for liquidity and you have long-duration notes trading at a loss, those are often the most tax-efficient positions to sell. The opposite is also true: notes with large gains should typically not be sold, unless the liquidity need is more important than the tax cost.

How to Prioritize Sales (Tax-Efficient Ranking)

When deciding what to sell for tax-minimization purposes, the hierarchy for a high-state-tax resident to save on taxes is as follows:

- Treasuries with losses – the cleanest, most tax-efficient source of liquidity.

- Treasuries with minimal gains – raise cash without much tax cost.

- Coupon-bearing Treasuries before zero-coupon bills – because selling zeros converts state-exempt interest into taxable gains.

- Avoid selling zero-coupon bills and high-gain positions unless necessary.

This sales hierarchy minimizes taxes, but sometimes paying taxes is still the right move, just as I ultimately decided in my own case.

When Selling Early Does Make Sense

Despite the tax considerations, there are situations where selling early is the better move:

- You’re in a low-income or low-tax year.

- You’re reinvesting into an opportunity with better expected returns.

- The position has a loss or only a tiny gain.

- You need to rebalance duration or risk.

- You expect interest rates to climb back up, causing Treasury bond prices to go down

I Sold Treasury Bills For Hopefully Better Investment Returns

As the family’s money manager, one of my goals is to outperform the historical return of our target asset allocation. If our long-term mix is 60/40, for example, then the benchmark is roughly an 8.4% annual return. To try to beat that, I occasionally need to make active investment decisions, some of which will work and some of which won’t.

Those decisions, and the responsibility behind them, are what sometimes make managing our family’s finances feel like a full-time job. Unfortunately, the more money you manage for family, the more stressful it can be due to the larger potential absolute losses. This is a topic that I will discuss further regarding what happened after managing a relative’s money for a year.

Ultimately, I decided to sell about $110,000 of Treasury bills before maturity after the S&P 500 pulled back ~6% in November, several tech names I follow dropped 10%–20%, and Bitcoin slid around 30% from its peak.

Paying capital gains tax on, at most, $4,400 in interest income felt like a reasonable price to buy into these opportunities. The tax hit was similar to what I’d owe if the same $110,000 were parked in a 4% money market fund anyway. In reality, my capital gain was less than $2,000.

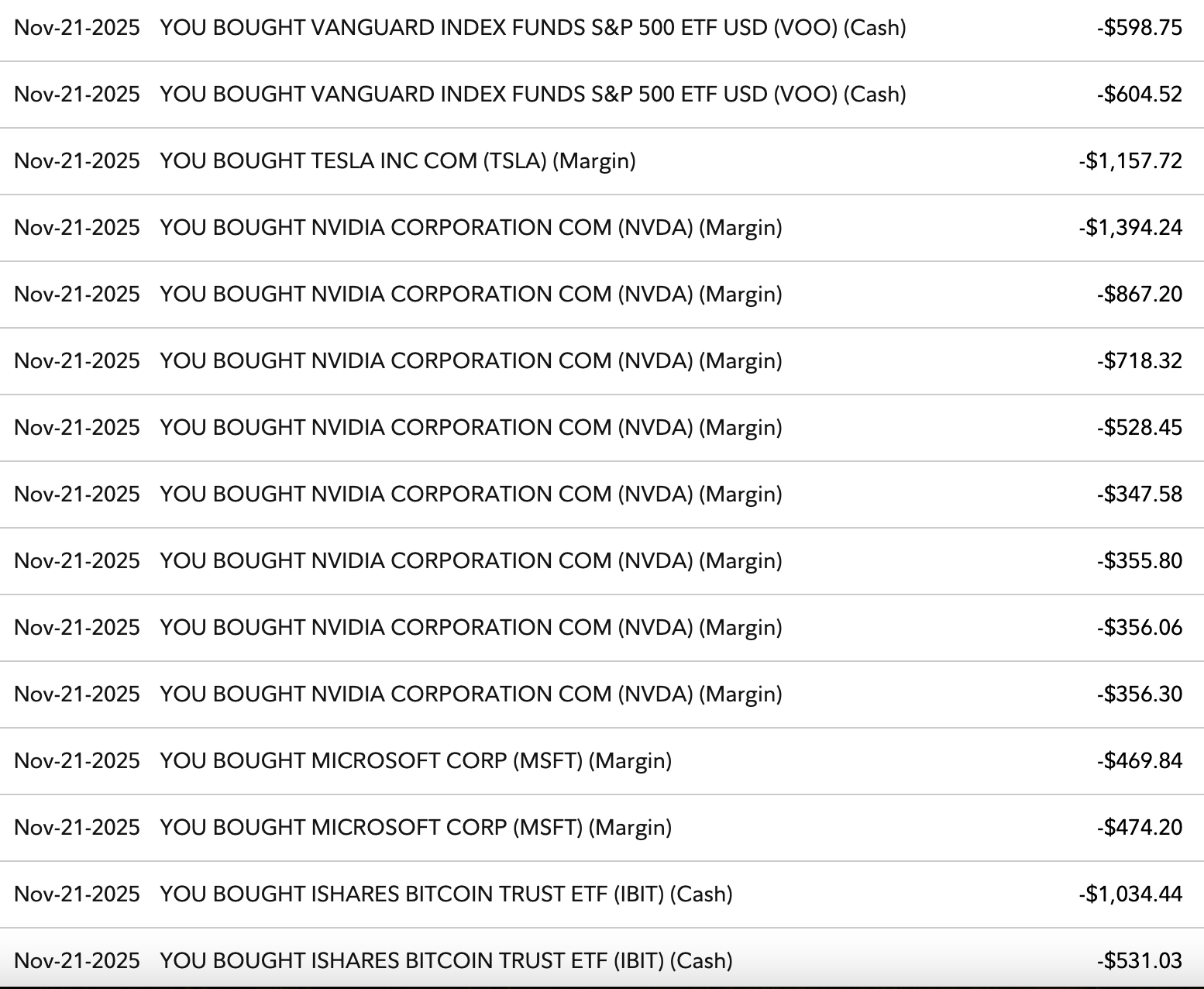

Some Purchases With The Treasury Bill Proceeds

I wanted to buy Tesla below $400, as I’ve held shares since 2018 and still believe in their long-term potential in robotics and autonomous vehicles.

I also picked up Nvidia after its earnings-day sell-off. The stock initially popped several percent, then reversed. I think fears about Google relying on TPUs instead of Nvidia chips are overstated as industry demand still far exceeds supply.

After Microsoft sold off roughly 13% from its peak, I added shares there as well. It’s a safer way to play AI, and similar to Google, which also generates enormous free cash flow. I’ve owned big tech names for decades, and plan to continue buying. Concurrently, I’m building a new $500,000 private AI company position through Fundrise Venture.

Finally, I used the dip to add to Bitcoin when it was at $85,000 through the IBIT ETF. Following a massive liquidation event in October and with a pro-crypto administration in place, I felt a 30% sell-off was a good entry point.

Only time will tell whether these investments will return more than the ~4% one-year guaranteed return for Treasuries. Luckily, I have more Treasury bonds behind.

Maximizing Treasury Efficiency Without Missing Opportunities

Treasuries provide excellent liquidity, but the tax treatment matters. To stay efficient, hold zero-coupon bills to maturity, sell positions with losses first, and use coupon Treasuries with minimal gains for routine liquidity needs. Large embedded gains and zero-coupon bills should be sold only when the benefit outweighs the state-tax cost.

That said, if you spot investment opportunities that may outperform your Treasuries, then you may want to sell some and reinvest. After all, having liquidity to buy the dip is one of the main reasons you own Treasuries in the first place.

Readers, are you aware of the tax implications for selling Treasuries before maturity? How do you use and view your Treasury bond holdings?

Suggestions

If you’re interested in gaining exposure to private AI companies, check out Fundrise Venture. It holds stakes in firms like OpenAI, Anthropic, Anduril, Databricks, and more. Private companies are staying private far longer than in the past, allowing early investors to capture significant gains. The minimum investment is just $10. Fundrise has been a long-time sponsor of Financial Samurai, and our investment philosophies are closely aligned.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. You can also get my posts in your e-mail inbox as soon as they come out by signing up here. Everything is written based on firsthand experience and expertise.

Read the full article here