As I watch my stock portfolio correct, I take solace in knowing that my real estate portfolio continues to chug along despite the chaos, fear, and uncertainty.

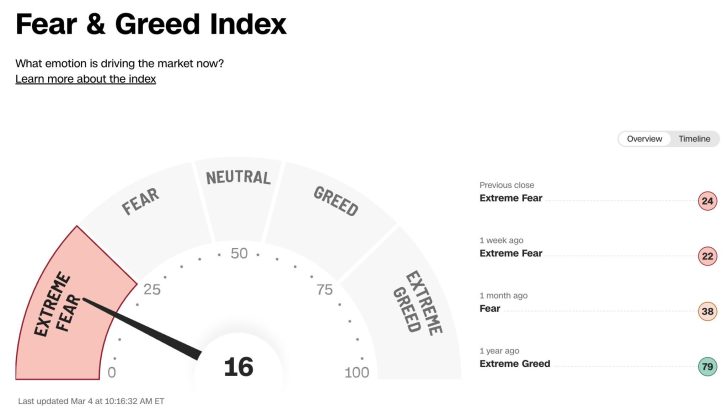

With mass government personnel cuts, new tariffs against Mexico, Canada, and China, a heated Oval Office exchange between President Trump and Ukraine’s President Zelensky, and sharp words from VP Vance about Europe, economic uncertainty is surging. While the stock market despises uncertainty, real estate investors might find opportunity in the turmoil.

The Start of Trade Wars In March 2025

In 2023, Canada sent 76% of its exports to the United States, accounting for 19% of its GDP. In 2024, Mexico sent 78% of its exports to the U.S., making up 38% of its GDP. Meanwhile, U.S. exports to both Canada and Mexico combined account for only about 2.7% of U.S. GDP. Clearly, Canada and Mexico will need to make concessions—otherwise, their economies will likely slip into recession.

I expect swift negotiations among these four countries, which is why I’m buying the stock market dip. In a way, I’m thrilled to be able to build great equity positions for my children, who have small stock market portfolios. At the same time, I see real estate as both a hedge against uncertainty and a potential outperformer this year and next.

How Political and Economic Chaos Impacts Investments

When uncertainty spikes, equity markets typically sell off. Since stocks produce nothing tangible, their value relies on investor confidence and the ability to forecast future earnings. But investors fear the unknown—much like stepping into an already stinky elevator, only to have someone else walk in and assume you’re the culprit.

However, real estate thrives in times of uncertainty. Why? Because capital seeks safety and tangible assets. When stocks tumble, investors flock to Treasury bonds and hard assets like real estate and gold, which tend to hold their value better. While equities can lose 10%+ in market cap overnight, real estate remains a tangible, income-generating asset.

I previously wrote about how trade wars could reignite the housing market. That prediction appears to be playing out now. With interest rates inching lower, the demand for real estate is increasing.

The Impact of DOGE Cuts & Economic Uncertainty

To get a clearer picture of the situation in Washington, D.C., I reached out to Ben Miller, co-founder and CEO of Fundrise, who is based in Washington D.C.. His insights were eye-opening, including the discussion of taking away, “stealth stimulus.” You can listen to the episode by clicking the embedded player below or going to my Apple or Spotify channel.

The DOGE cuts are happening much faster than expected, amplifying their impact. If the cuts were gradual, their effects would be more manageable. Instead, the government is slashing jobs at an unprecedented pace, aiming to root out waste and graft.

While we can all agree that taxpayers deserve transparency in where our money is going and efficiency in government spending, the speed and scale of these cuts—along with the lack of empathy for long-serving public employees—are concerning. My college roommate worked for USAID for eight years, doing great work helping to distribute food and vaccinations in Africa—now he’s shut out through no fault of his own.

Sitting here in San Francisco, the tech and startup hub of the world, I can’t help but see parallels with the private sector. In tech, layoffs happen swiftly, and companies move on without hesitation. It’s a brutal, competitive world.

If you’re a government employee facing uncertainty, it may be wise to consider accepting a severance package and move on. The next four years—perhaps longer—will bring immense pressure on federal and local employees to perform under intense scrutiny.

You might even feel as much pressure as a personal finance writer raising two young kids and supporting a spouse in expensive San Francisco—with no dual incomes! If you don’t love what you do, survival will be extremely difficult.

Which Sectors Thrived During the Last Trade War?

With fresh trade conflicts brewing with China, Mexico, Canada, and possibly Europe, it’s worth revisiting past market behavior.

During the 2018–2019 trade war, Goldman Sachs found that the top-performing sectors were:

- Utilities – Low-beta monopolies with high dividends

- Real Estate – Hard assets that offer stability and income

- Telecom Services – Defensive, cash-generating businesses

- Consumer Staples – Essential goods that remain in demand

- Energy – A hedge against geopolitical instability

Real estate’s outperformance during turmoil isn’t surprising. When uncertainty rises, investors rush into bonds, pushing yields lower. Declining mortgage rates then make homeownership more affordable, boosting housing demand.

Why Real Estate Could Outperform Stocks in 2025

While real estate underperformed stocks in 2023 and 2024, that trend is poised to reverse in 2025. I assign a 70% probability that real estate will outperform equities this year.

Stocks are at risk of sharp corrections mainly due to expensive valuations and policy uncertainty, while real estate continues to provide stable, low-volatility returns—something investors crave in turbulent times. The U.S. already faces a multi-million-unit housing shortage. With falling mortgage rates, pent-up demand, and a growing preference for stability, real estate should see strong support.

That doesn’t mean real estate will explode higher—it just means stocks likely won’t deliver the same outsized gains we saw in 2023 and 2024.

Ask yourself:

- Would you rather invest in stocks at all-time highs, with valuations in the top decile, amidst all this uncertainty?

- Or would you prefer commercial real estate with 7%+ cap rates, trading at deep discounts similar to the 2008 financial crisis—despite today’s stronger economy and household balance sheets?

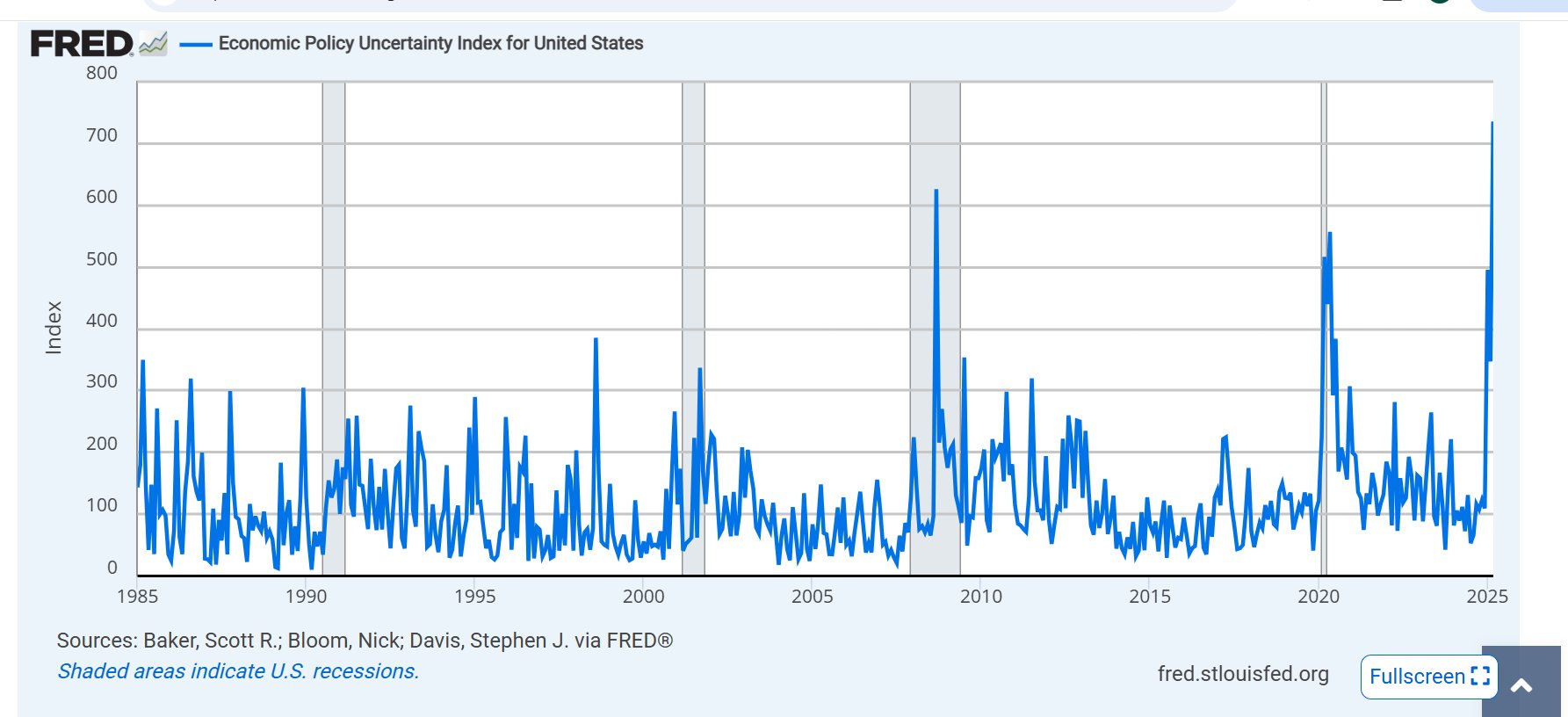

I lean toward laggard value plays over frothy stocks. At the same time, some of the best times to buy stocks were when the Economic Uncertainty Index was at similarly elevated levels—like in 2009 and 2020. Hence, it may be wise to dollar-cost average into both assets.

Don’t Get Complacent With Stock Market Gains

The past two years have been exceptional for stocks, delivering returns that felt like winning the lottery. But long-term returns tend to normalize. Goldman Sachs, JP Morgan, and Vanguard all forecast subdued 10-year S&P 500 returns. If valuations mean-revert to a historical forward P/E of 18x, upside potential is limited. In fact, there could be tremendous downside.

Once you’ve made substantial gains, capital preservation should be your priority. The first rule of financial independence is not losing money. The second rule is not to forget the first rule—but also to always try to negotiate a severance package if you plan to quit your job anyway. There is no downside.

2023 and 2024 were gifts from the market. Let’s not assume 2025 will be just as generous. Instead, it’s time to appreciate real estate and consider adding more if you’re underweight. A 4%–8% steady return in real estate beats the wild swings of a stock market that could erase wealth overnight.

Conclusion: Hard Assets Win During Uncertainty

When chaos, fear, and uncertainty dominate, investors should return to the basics—income-generating assets and tangible assets. Hard assets provide utility, stability, and in some cases, joy.

As 2025 unfolds, don’t underestimate real estate’s role as a hedge against uncertainty. If the world comes crumbling down, the most precious asset you will own is your home. Don’t take it for granted.

If you want to invest in real estate without the burden of a mortgage, tenants, or maintenance check out Fundrise. With about $3 billion in assets under management and 350,000+ investors, Fundrise specializes in residential and industrial real estate. I’ve personally invested $300,000 with Fundrise to generate more passive income. The investment minimum is only $10, so it’s easy for everybody to dollar-cost average in and build exposure.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009. Everything is written based on firsthand experience and expertise.

Read the full article here