Now that I’ve shared the 2025 S&P 500 target price forecast, let’s dive into housing price forecasts for 2025. The outlook from housing analysts is positive, with expected gains ranging from -0.4% to 10.8%, and an average of about 3%. The only negative housing price forecast comes from Moody’s, which predicts a slight decline of -0.4% largely due to affordability constraints.

Here’s a summary of 2025 housing price forecasts from various institutions, listed alphabetically:

- Apollo Global Management: 10.8%

- Bank of America: 4.7%

- CoreLogic: 2.3%

- Fannie Mae: 3.6%

- Freddie Mac: 0.6%

- Goldman Sachs: 4.4%

- HousingWire: 3.5%

- Moody’s: -0.4%

- Morgan Stanley: 3%

- Mortgage Bankers Association: 1.5%

- National Association of Realtors (NAR): 2%

- Redfin: 4%

- Wells Fargo: 4.9%

- Zillow: 2.9%

Real Estate as a Foundational Asset Class To Build Wealth

With the vast majority forecasts predicting positive real estate price growth in 2025 and roughly 63% of Americans owning property, the future looks promising for most Americans.

I firmly believe that consistently investing in stocks and real estate throughout your working career is key to building a fortune large enough to retire comfortably. Once you’ve established these foundational asset classes, you can then explore alternative investments like venture capital, crypto, fine wine, and collectibles.

Real estate remains my favorite wealth-building asset class for the average person. Without owning real estate, I wouldn’t have been able to retire in 2012 and stay semi-retired since. Real estate offers several advantages:

- Tangible Value: It provides shelter and doesn’t vanish overnight like some stocks.

- Inflation Hedge: Real estate values often rise with inflation.

- Tax Benefits: It enjoys favorable tax treatment.

- Income Generation: Rental properties can produce steady cash flow.

- Simplicity: It’s easier to understand compared to many alternative investments.

Fixing Housing Costs for Financial Freedom

If you seek financial freedom, for most people, the first step is to own a primary residence to stabilize housing costs. Once you’ve largely fixed your housing expenses, life becomes more manageable, freeing up cash flow to invest or spend as you wish.

To fully capitalize on real estate’s potential, consider going beyond your primary residence by:

- Buying rental properties.

- Investing in publicly traded REITs (Real Estate Investment Trusts).

- Investing in private real estate funds or individual deals for diversified exposure.

Let’s look into more detail at the 2025 housing price forecasts by Wells Fargo, Mortgage Bankers Association, Fannie Mae, Goldman Sachs, and Redfin.

Wells Fargo 2025 Housing Price Forecast: +4.4%

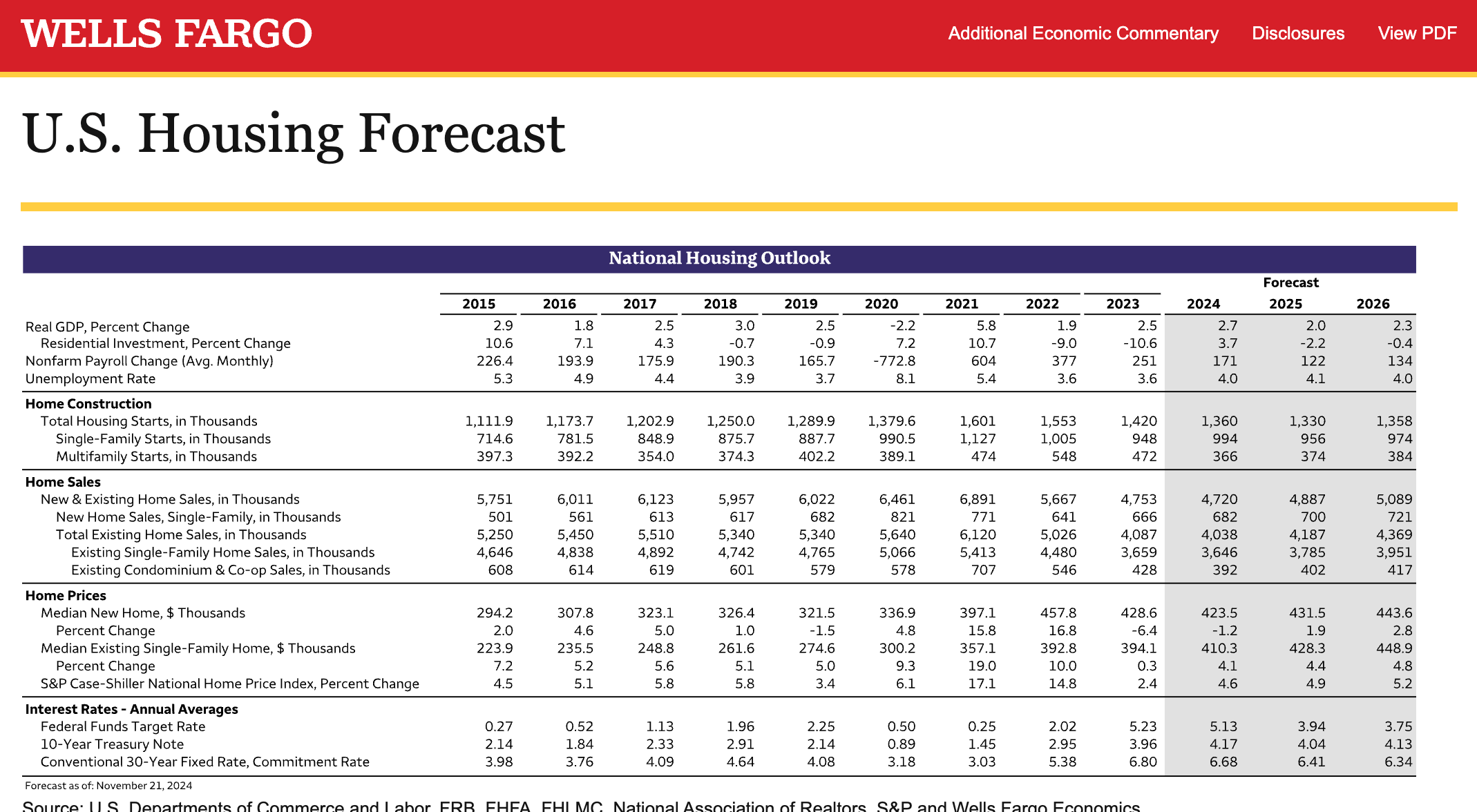

Wells Fargo’s forecast model projects the median existing home price to increase by +4.4% in 2025 and +4.8% in 2026, following an estimated +4.6% gain in 2024. Separately, Wells Fargo predicts the S&P Case-Shiller National Home Price Index will rise +4.9% in 2025 and an even stronger +5.2% in 2026.

This is among the more bullish forecasts, which is notable given that Wells Fargo, as a bank, is less likely to be as biased as real estate-focused companies in their predictions. However, it’s worth acknowledging that Wells Fargo also profits from its mortgage department, which could influence their optimism.

The S&P Case-Shiller Index uses a repeat-sales method, tracking the price changes of the same homes over time. This approach filters out the effects of varying home types and qualities, focusing exclusively on price appreciation or depreciation. The index notably excludes new construction and condos, offering a narrower but more consistent view of the housing market.

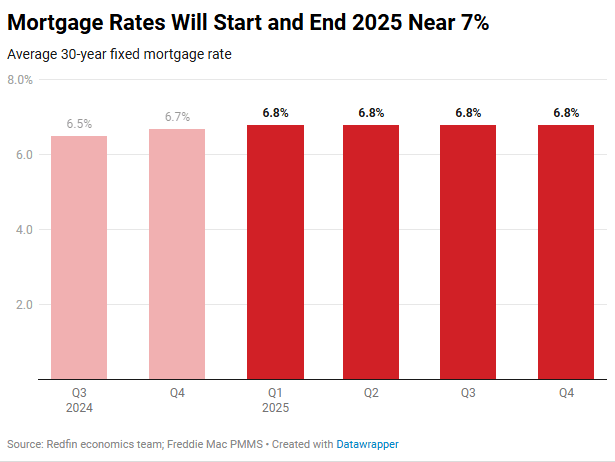

What’s even more intriguing is that these bullish housing price forecasts come alongside Wells Fargo’s estimates for bond yields and mortgage rates. They predict the 10-year bond yield will average 4.04% in 2025 and 4.13% in 2026, while the 30-year fixed mortgage rate is expected to average 6.41% in 2025 and 6.34% in 2026. In other words, Wells Fargo isn’t forecasting a significant drop in bond yields or mortgage rates compared to year-end 2024 levels.

This suggests that despite higher financing costs, housing prices are expected to rise steadily, supported by other market dynamics.

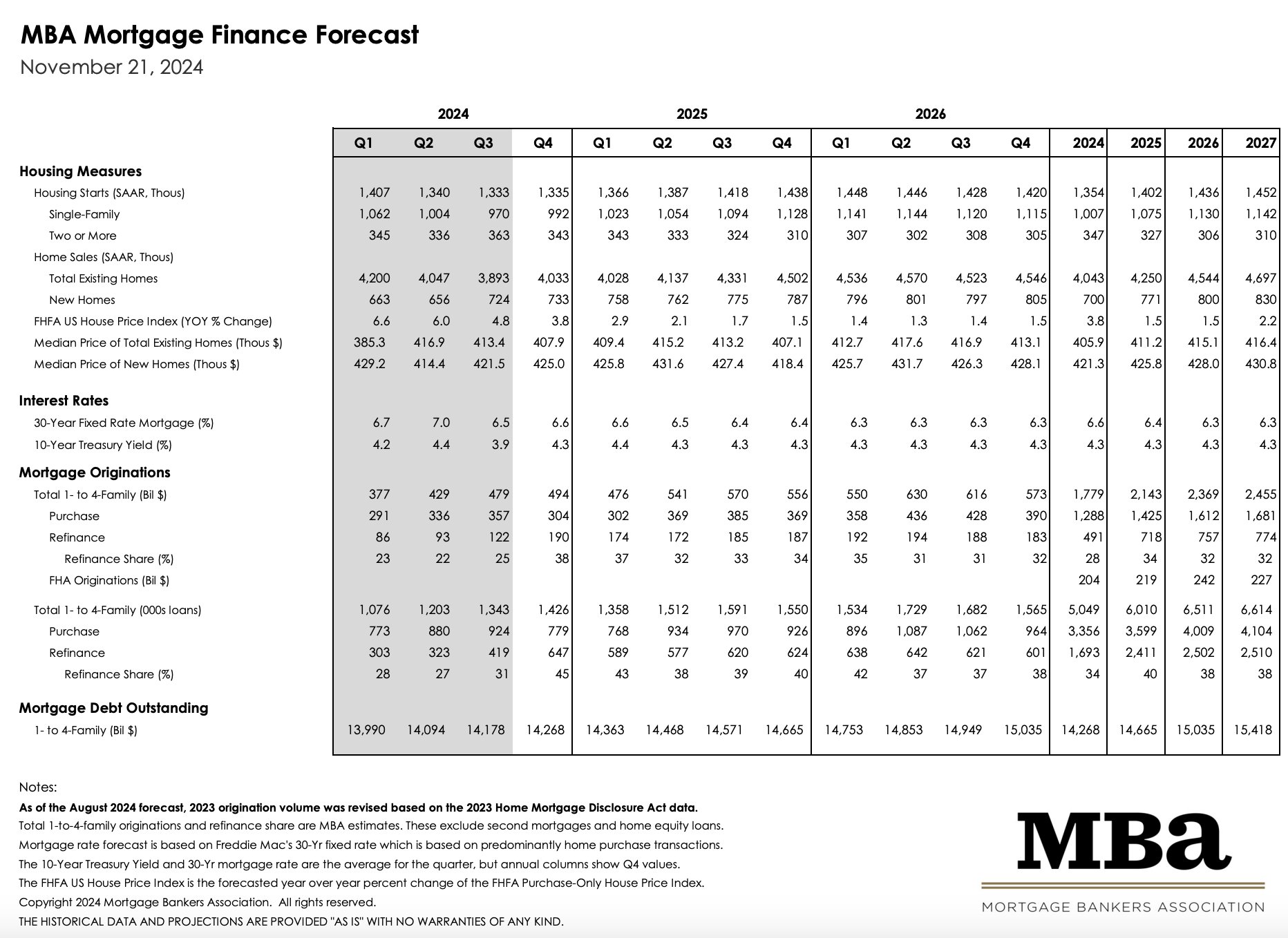

MBA 2025 House Price Forecast: +1.5%

The Mortgage Bankers Association expects U.S. home prices, as measured by the FHFA US House Price Index, to rise by only +1.5% in 2025, +1.5% in 2026, and +2.2% in 2027. MBA expects the average 30-year fixed rate mortgage to be 6.4% in 2025, 6.3% in 2026, and 6.3% in 2027.

A prediction of only a 1.5% housing price gain for 2025 seems more reasonable given the MBA expects the 30-year fixed to average 6.4% in 2025. Housing affordability is strained due to high home prices and stubbornly higher mortgage rates.

The Mortgage Bankers Association (MBA), founded in 1914, is a national association representing the real estate finance industry in the United States. It advocates for lenders, mortgage brokers, and other stakeholders in the housing finance ecosystem. The MBA provides its members with research, education, and policy advocacy, focusing on promoting sustainable homeownership and the stability of the housing market. It also analyzes and forecasts key industry metrics.

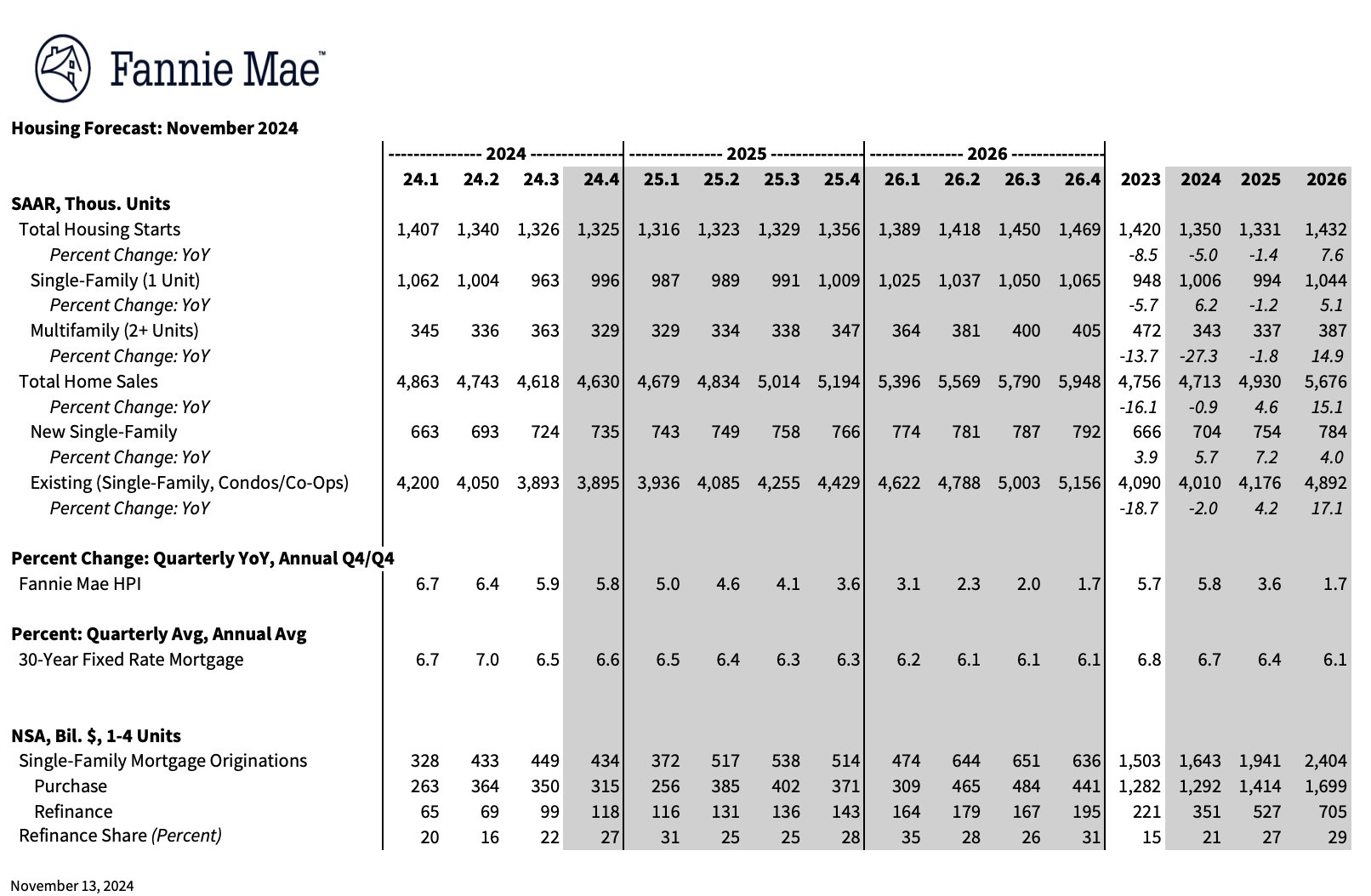

Fannie Mae 2025 Housing Price Forecast: +3.6%

Fannie Mae’s latest forecast expects U.S. home prices, as measured by the Fannie Mae Home Price Index, to rise +3.6% in 2025 and +1.7% in 2026. The institution expects the average 30-year fixed mortgage rate to be 6.4% in 2025 and 6.1% in 2026. The only thing interesting about Fannie Mae’s forecast is the slowdown in housing price appreciation for 2026.

Fannie Mae, officially the Federal National Mortgage Association (FNMA), is a government-sponsored enterprise (GSE) established in 1938 to expand access to affordable housing and ensure liquidity in the U.S. mortgage market. It does not originate loans but instead purchases mortgages from lenders, packages them into mortgage-backed securities (MBS), and sells them to investors. This process provides lenders with capital to issue more loans, stabilizing the housing market. Fannie Mae operates under congressional oversight, balancing its mission to support homeownership and rental housing with the need to maintain financial sustainability.

Goldman Sachs 2025 Housing Price Forecast: +4.4%

Goldman Sachs raised its US home price appreciation forecast to 4.5% for 2024 and 4.4% for 2025, up from earlier estimates of 4.2% and 3.2%, respectively, in April. The upgrade is driven by lower mortgage rates and a resilient economy.

What’s particularly interesting in Goldman’s 2025 housing outlook is its regional forecast. Here’s a summary from their post:

Home prices have surged year-to-date in three key areas: the Midwest, Northeast, and California. The Midwest, with cities like Cleveland and Chicago, remains the most affordable. The Northeast, led by strong performances from New York and Boston, has also seen solid growth. California, especially San Diego, exceeded expectations despite initial predictions of poor performance, thanks to tight land-use regulations and low loan-to-value ratios.

Goldman expects strong price growth in California, with cities like San Jose potentially seeing up to 10% appreciation over the next year—San Francisco could follow suit due to its proximity and similar workforce. On the other hand, Goldman is cautious about the Southeast, particularly Florida, due to slower real income growth, affordability challenges, and rising insurance costs.

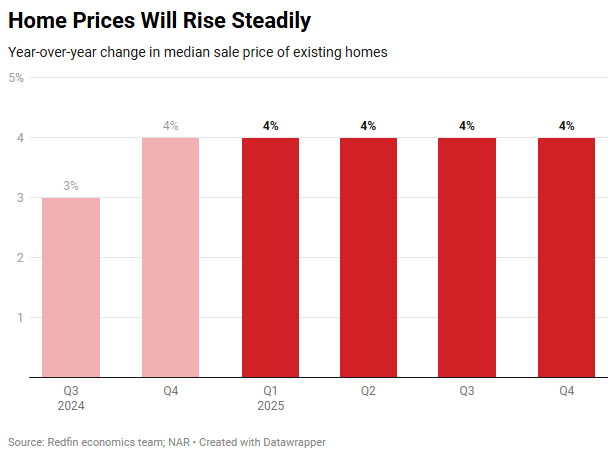

Redfin 2025 Housing Price Forecast: +4%

Between Zillow and Redfin, I prefer Redfin for its user-friendly interface, more accurate data, and more precise home price estimates. Zillow’s estimates are harder to trust, especially after its iBuying business failed, costing the company hundreds of millions of dollars.

Redfin’s 2025 housing price forecast stands out for predicting a 4% rise in prices and an increase in the average 30-year fixed mortgage rate to 6.8%. It also projects the Fed will cut the Fed Funds rate just twice, totaling 0.5%, instead of the expected four cuts (1%). Redfin cites a strong economy, tax cuts, and tariffs as key drivers of elevated inflation and interest rates.

I’m glad to see Redfin predicting a decline in real estate commissions, particularly for luxury homes. They note, “It remains to be seen how aggressively antitrust enforcers in the incoming administration will pursue additional real-estate industry reforms.” The Department of Justice recently stated it “continues to scrutinize policies and practices in the residential real estate industry that may stifle competition,” though any formal action remains uncertain.

For more details, you can read Redfin’s 2025 housing post.

The Most Bullish 2025 Housing Price Forecast Is From Apollo Global Management: 10.8%

For housing bulls like me, Apollo Global Management’s 2025 housing price forecast of a 10.8% increase is remarkable. There would be less of a need to work thanks to investments outperforming work income. This bullish outlook starkly contrasts with the historical average annual home appreciation of 4%-5% since 1976.

However, I give Apollo’s forecast only a 20% chance of materializing. Home prices have already risen significantly since the pandemic began in 2020, and affordability remains a major challenge.

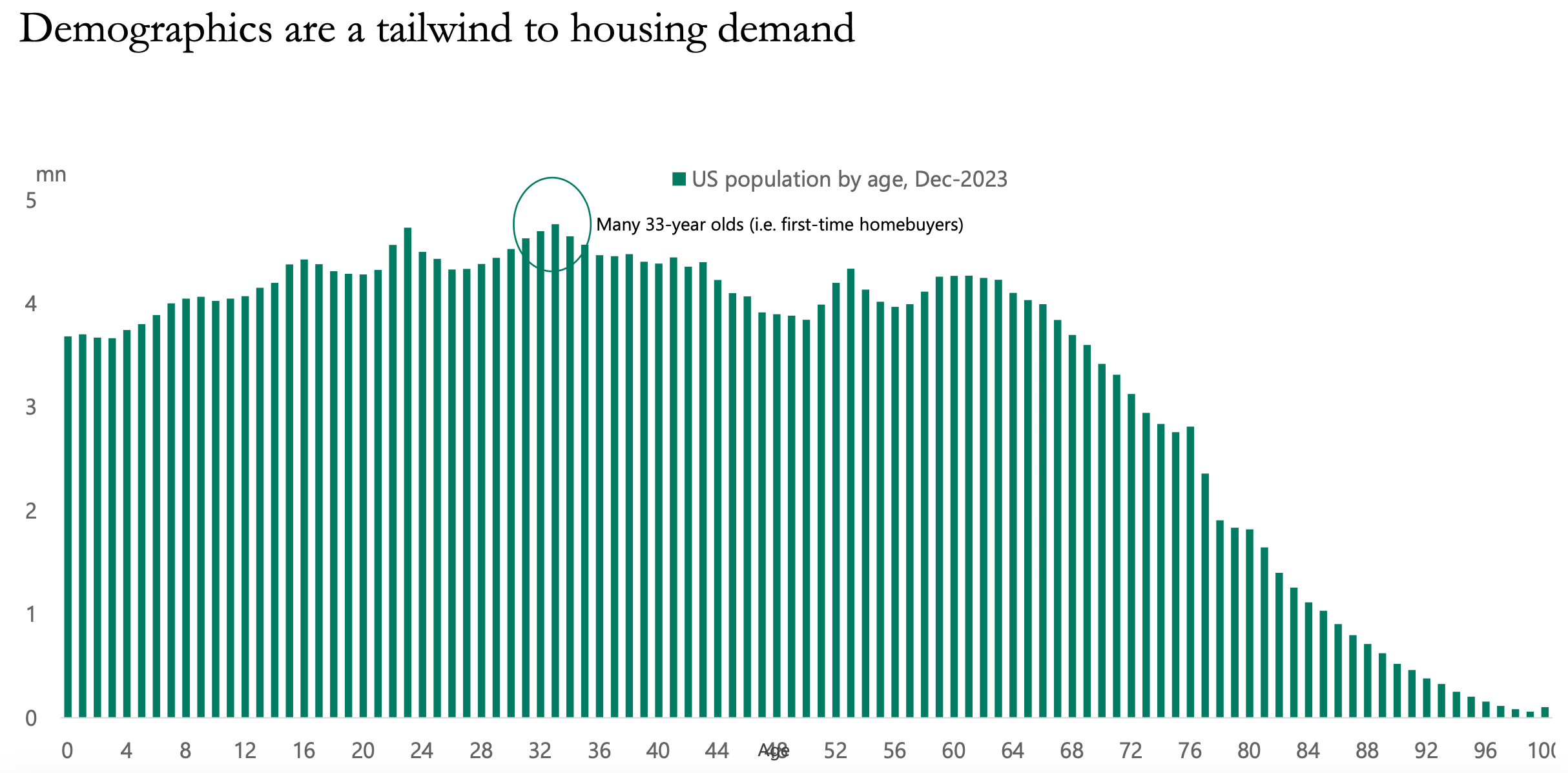

In 1981, the median age of a homebuyer in America was 31, and 44% of all home purchases were by first-time homebuyers. In 2024, the median age of a homebuyer has climbed to 56, while first-time buyers now make up just 24% of all purchases—the lowest percentage in recorded history.

Here are 10 facts from Apollo as to why they are so bullish.

The thing is, their “report” is just a bunch of charts and doesn’t explain HOW Apollo comes up with a +10.8% housing price increase forecast for 2025. So you’ll have to come to your own conclusion. You can see their more detailed housing report here.

- US homes are getting smaller: The size of new homes being built has declined by 12% since 2016

- The median age of all homebuyers is now 49 years old, up from 31 in 1981

- 40% of US homes don’t have a mortgage

- The average number of homes sold per real estate agent every year is 21, down from 54 in 2004

- Households’ equity in real estate is at a record high 73% of housing values

- A record high of 36% of Americans say they would rent if they were going to move

- More than half of all mortgages outstanding have an interest rate below 4%

- 95% of mortgages outstanding are a 30 year fixed rate

- 63% of all mortgages outstanding were issued after 2018

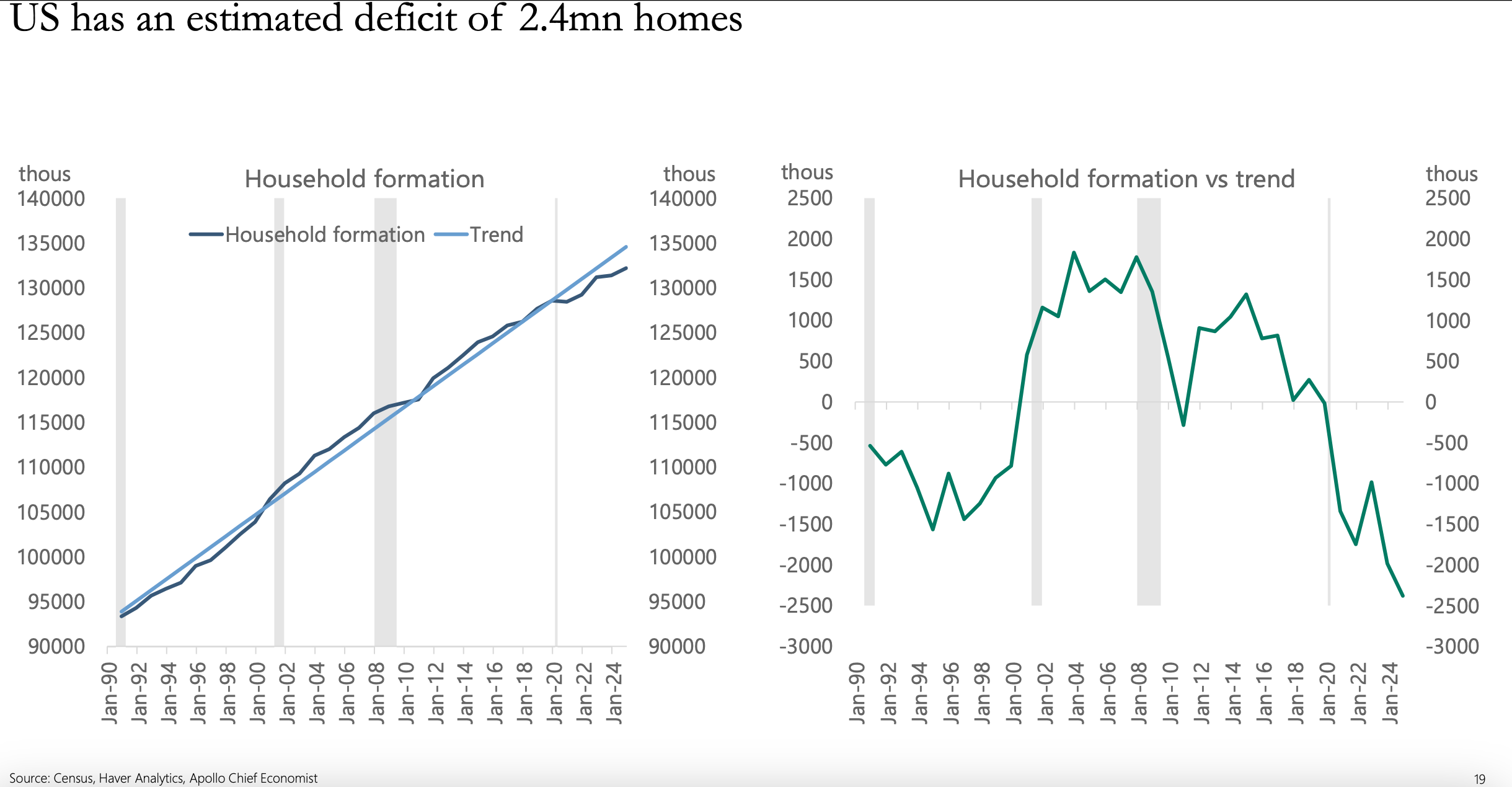

- The U.S. has a deficit of 2.4 million homes

Apollo Global Management (ticker: APO), with over $500 billion in assets under management, is a leading global alternative asset manager specializing in private equity, credit, and real assets. Founded in 1990, and headquartered in New York City, Apollo manages assets across various investment strategies, including buyouts, debt, infrastructure, real estate, and growth equity.

Financial Samurai 2025 Housing Price Forecast: +5.5%

I’m bullish and biased on real estate, my favorite asset class to build wealth. Roughly 45% of my net worth is tied up in my primary residence, physical real estate, and private real estate funds. After underperforming the S&P 500 in 2023 and 2024, I expect real estate to perform above its 4% long-term average in 2025 for several reasons:

- Pent-up demand after the Fed’s 11 aggressive rate hikes starting in 2022 put a halt to buyers.

- Stock market gains fueling wealth creation, with some profits likely shifting into real estate.

- Lower mortgage rates driving increased buyer activity.

- Millennial homeownership growth, as this generation is in its prime buying years.

- Real income growth supporting affordability.

- Real estate’s rise as a growing asset class for investors and retirees.

A 5.5% increase in 2025 would push the median existing home price to around $435,000. What excites me most, however, is the resurgence of demand in coastal cities like San Francisco, Seattle, Boston, and New York. These cities have strict building regulations, making it harder to increase supply, and are benefitting from the growing return-to-office trend.

U.S. Real Estate Prices Continue To Re-Rate Higher In 2025

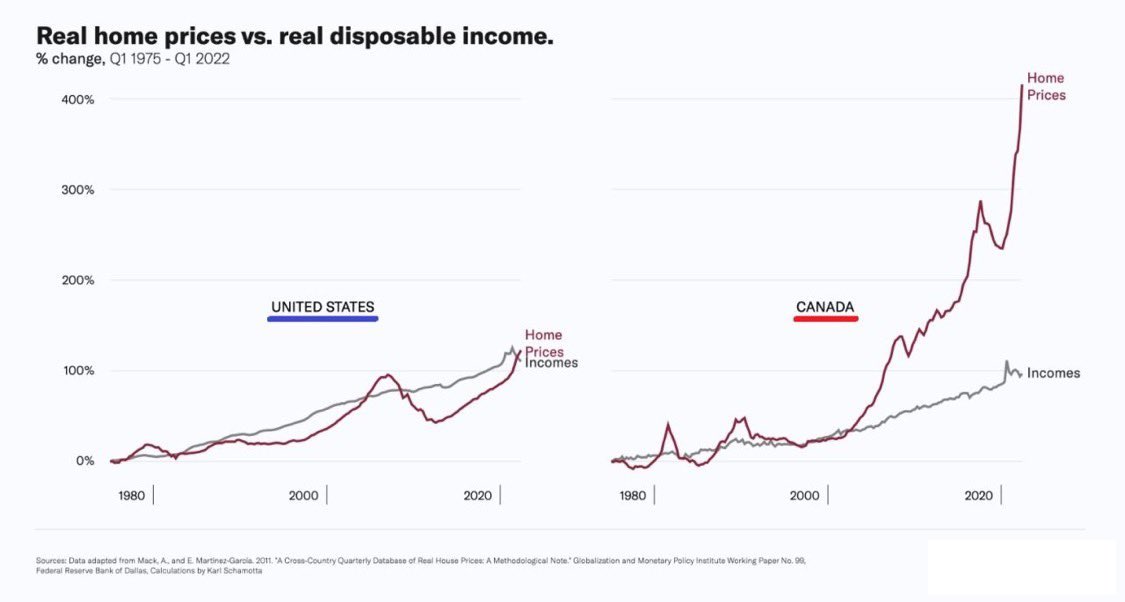

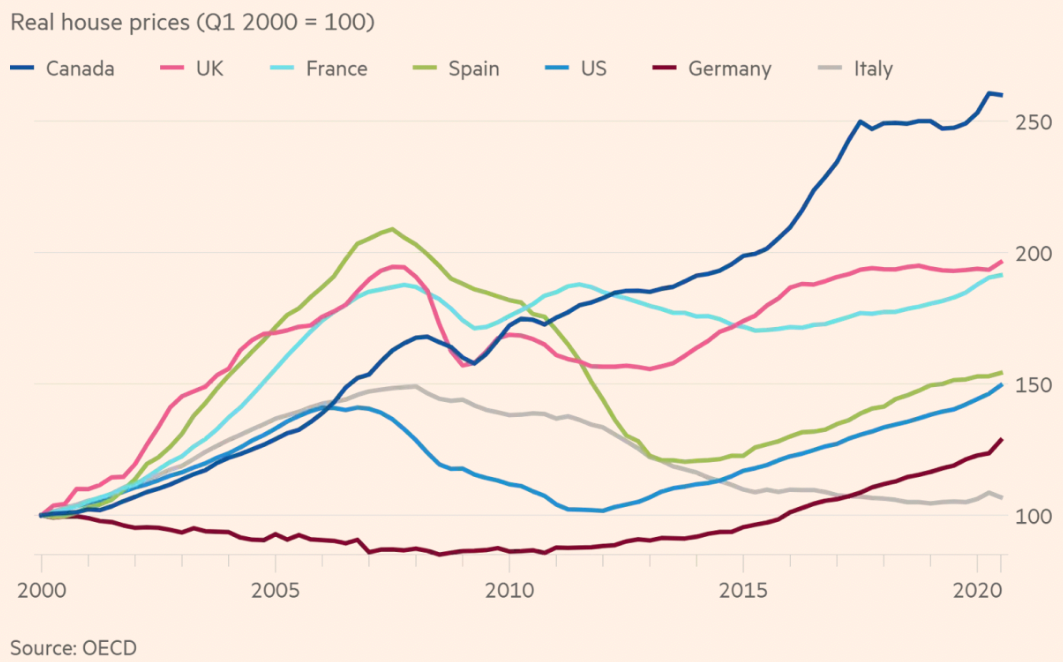

We’re in the midst of a 30-year structural shift in U.S. real estate, where prices are likely to become permanently higher. Compared internationally, U.S. property remains among the most affordable, especially relative to its income-generating potential.

Look no further than Canada for perspective. U.S. real estate is not only cheaper, but the average worker in the U.S. earns more. The big question is: will Canadian housing prices fall to U.S. levels, or will U.S. prices rise to match Canada and other pricier countries? My bet is on the latter, as economic devastation isn’t in anyone’s interest.

As of late 2024, Canada’s median home price is approximately $696,166 CAD (~$522,125 USD), according to the Canadian Real Estate Association (CREA). Meanwhile, the U.S. median existing home price is around $420,000 USD, per the St. Louis Fed. When it comes to earnings, the median household income in the U.S. is $80,610 USD (2023), compared to $52,875 USD (2023) in Canada.

In other words, U.S. citizens enjoy significant relative home affordability. The median Canadian home price is 10 times the median Canadian household income. Applying the same 10X multiple to the U.S. median household income would result in a median home price of $806,100—92% higher than the current figure!

U.S. Real Estate Is Cheap Compared To Other Developed Countries

If you spend time traveling around the globe, you’ll quickly realize just how affordable U.S. real estate is by comparison. Cities like Monaco, Hong Kong, Singapore, London, and Geneva have median home prices that make even the most expensive American cities, like San Francisco and New York, look like bargains.

It’s no wonder international demand for U.S. real estate remains so high. Foreign investors recognize the incredible value and opportunity in the American market. The question is—do we? Recognizing and leveraging this value can help us appreciate the relative affordability and investment potential of U.S. property.

Real Estate Should Be A Core Part Of Your Investments

If you’re not at least neutral on real estate by owning your primary residence, you’re doing yourself a disservice. If you have young children or plan to, I’m confident they’ll wonder in 20–30 years why you didn’t buy U.S. real estate when prices were so affordable. Foreigners worldwide recognize the value of U.S. real estate—so should we.

Here’s to making 2025 a great year for real estate and living life on your terms!

Readers, how much do you think housing prices will move in 2025? Is housing in America destined to stay permanently expensive, like in Canada and other developed countries? What risks do you see that could derail the housing market?

Diversify Into High-Quality Private Real Estate

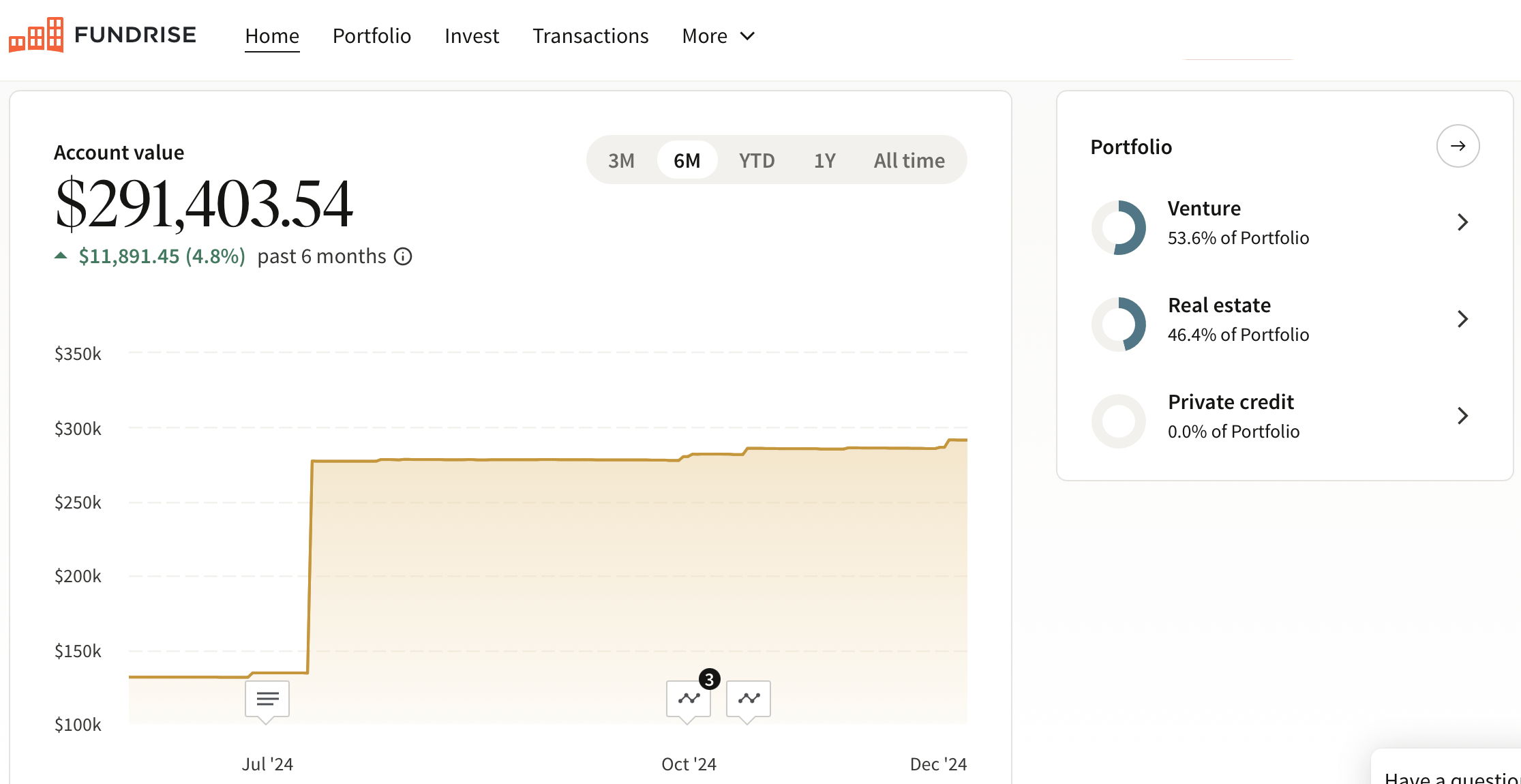

To invest in real estate, consider Fundrise, a platform that allows you to 100% passively invest in residential and industrial real estate. With over $3 billion in private real estate assets under management, Fundrise focuses on properties in the Sunbelt region, where valuations are lower, and yields tend to be higher.

As the Federal Reserve embarks on a multi-year interest rate cut cycle, real estate demand is poised to grow in the coming years.I’ve personally invested over $290,000 with Fundrise, and they’ve been a trusted partner and long-time sponsor of Financial Samurai. With a $10 investment minimum, diversifying your portfolio has never been easier.

Read the full article here