With 2024 almost done, I’d like to share my year in review. For the vast majority of investors, this was a banner year, with the S&P 500 up ~25% and real estate prices in most of the country continuing to inch higher despite high mortgage rates. Bitcoin investors, gold investors, and venture capital investors have all done well too.

2024 was a year of luck because most investors didn’t think we’d do so well, including myself. The average Wall Street forecast for 2024 was 4,861, with the most bullish forecast at 5,500. Therefore, it feels like at least 15% out of the 25% gains are a bonus. And with 2025 S&P 500 forecasts averaging about 6,500 and 2025 housing price forecasts calling for a 4% increase, we may still get even luckier!

2024 was a transition year for me as I moved from not working to working part-time for four months at a startup. Then, starting in September 2024, after being a stay-at-home dad since April 2017, my youngest began school full-time. Suddenly, I had a full 40 hours a week of free time to use. The transition has been smoother than expected. Once I got more free time, I appreciated it much more thanks to consulting earlier in the year.

Let me divide this review into four sections: Wealth, Health, Family, and Financial Samurai. I hope you will share in the comments how your year went as well.

2024 Wealth Year In Review: A-

Roughly 28% of my net worth is in public equities. Given my tech-heavy portfolios, I outperformed the S&P 500 by 10% in 2024, mirroring similar results in 2023. However, I underperformed by 7% during the 2022 bear market. This kind of volatility is the trade-off for being an active investor in individual stocks.

About 45% of my net worth is in physical real estate. After purchasing a new home in Q4 2023, physical real estate climbed to 50% of my net worth by early 2024, hitting my limit. Transferring productive assets from stocks and bonds into my primary residence slowed my net worth growth. San Francisco real estate is reportedly up 4% in 2024, while San Jose, 50 minutes south, has seen gains of 8%.

Commercial real estate, which makes up about 6% of my net worth, showed signs of recovery in mid-2024. Prices have risen 5-6% for the year after a challenging 2022 and 2023 due to aggressive Fed rate hikes. Fortunately, the fund I’m invested in has been acquiring quality distressed properties, which hold strong long-term potential.

Finally, about 15% of my net worth is in venture capital. As the S&P 500 rebounded in 2023, capital began flowing into high-growth AI companies. With private firms staying private longer and private investors capturing more gains, it’s logical to continue allocating capital to this sector. Some of these private companies are up 300% in just one year.

I ended up investing $148,000 in Fundrise Venture mid-year because I believe many of the portfolio companies will go public and have upside. ServiceTitan and Databricks are great examples. I would have invested more but I was liquidity constrained.

Net Worth Growth Target Achieved In 2024

Overall, my net worth grew between 14% and 18%, depending on how my real estate and private investments are valued.

Since retiring in 2012, one of my main net worth benchmarks has been to grow net worth by 2-3 times the risk-free rate of return. I want steady growth with less volatility so I don’t have to worry about money. Given the 10-year bond yield averaged about 4.1% for the year, my target was 8.2% to 12.3%.

When it comes to investing, everything is relative to what you can get risk-free by owning Treasury bonds. If you’re taking risk and not outperforming the risk-free rate consistently, then you should probably stop investing or consult with a financial professional.

I feel extremely lucky that I got to invest during another bull market in 2024. About 98% of my net worth is invested in risk assets, which means it’s been a fun two years. However, I’m also preparing to get hammered when the correction or bear market eventually returns again.

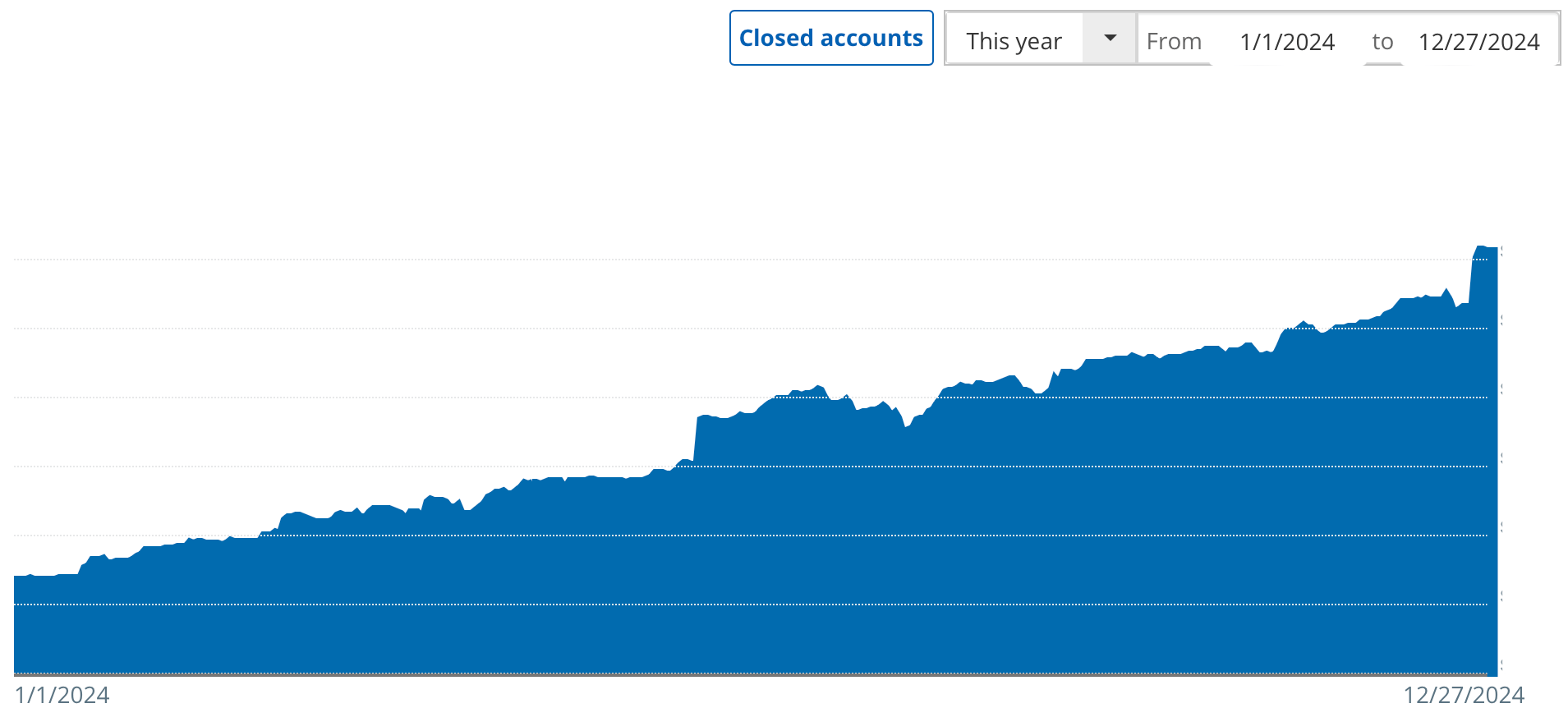

Another important realization is how powerful compounding is. During good times, the absolute dollar amount of returns grows tremendously, sometimes to multiple times your day job income. At this point, spending any amount of time working on something you don’t enjoy is truly a waste. Below is my net worth tracked using Empower.

Financial Areas In Need Of Improvement

I made the wrong choice of investing in index target-date funds for my children’s 529 plans. As a result, they have significantly underperformed the S&P 500 since first funding. I will rebalance more toward the S&P 500 (more risk) since they have 11-14 years left until college.

I didn’t put my children to work online, which means they didn’t have earned income to contribute to their Roth IRAs. This was another mistake since the S&P 500 did so well in 2024. I was so focused on rebuilding my investment exposure to equities that I forgot about theirs. However, I did put them to work landscaping and doing rental property maintenance.

2024 Health Year In Review: A-

Luckily, I’ve had no serious health issues. I had no doctor visits despite paying $2,500 per month in unsubsidized healthcare premiums, and no sprains or breaks. However, I did get a nasty stomach virus in December! Without health, it’s hard to appreciate or focus on anything else.

After gaining 5 pounds in 2020 during the height of the pandemic, I’ve been back to my steady-state weight of about 165-168 pounds since 2000. I’m convinced that about 70% of our body weight and body type is due to genetics. But that still leaves 30% up to us to eat well and exercise regularly.

Sports And Body Maintenance

In terms of fitness, I played tennis or pickleball three to four times a week all year, even during winter, because I’m a member of an indoor sports club. Paying $180/month for membership is great value for better health and camaraderie throughout the year. I highly recommend such a “splurge.” Your skill level should also improve, as I’m now a legit 4.5 pickleball player.

I love food and could eat wagyu NY strip, cheeseburgers, jamón ibérico, kalbi, milkshakes, and apple pies every week forever. But if I do, I might die younger and not be able to play with my young kids for longer than 10 minutes. So, I try to eat healthier foods.

An easy way to gauge food consumption is to match the intake of someone smaller than you. For example, I aim to eat the same amount as my wife, who weighs about 65 pounds less than me. By splitting portions evenly, managing your food intake becomes simpler and more intuitive.

Area for Improvement: Strength Training

At this point, I’m not concerned about weight maintenance anymore. Instead, I’m more focused on maintaining strength. Muscle mass begins to decline more rapidly after 40. I lifted weights maybe a total of six times in 2024, which is at least 46 times too few.

Coming to Hawaii for vacation, I’m always inspired by how fit some people are. Living in a place that’s warm year-round is a natural motivator to get in better shape, which is another reason why I want to move to Honolulu.

2024 Family Year In Review: B+

Being a parent of young children is hard. It’s harder than my stressful banking job, which required constant travel, 6 a.m. arrivals, and demanding clients. Having young children has also put a strain on my relationship with my wife. But at least I fulfilled my promise to be a stay-at-home dad to both kids for their first five years, so I feel satisfied that I tried my best.

I’m confident that if we were ever to go to divorce court, she cannot accuse me of being a deadbeat dad! Whoo hoo!

Despite four months of part-time consulting that sometimes bled into my time with my daughter while she was home on Tuesdays and Thursdays, I could not have spent more time with her. My main hope as a stay-at-home dad was that there would eventually be a correlation between effort and quality of relationship.

When my kids were between 1 and 3, that correlation was tenuous. Because my wife is also a stay-at-home parent, I was usually the second option. Feeling like chopped liver too often made me question why I wasn’t out working and making money instead. But after about age 3.5, it became clearer that the more time I spent with my kids, the more they appreciated it. Now, we have an incredibly loving relationship.

Enjoyable Progress

In 2024, I taught my four-year-old daughter how to swim and bike, a satisfying accomplishment for both her and me. We achieved these milestones a year ahead of my son. Perhaps having experience as a parent helps with teaching and being more confident about letting go.

Both children love their school and always want us to pick them up later. This has made paying for expensive private grade school more digestible, as is their learning Mandarin. My own Mandarin has steadily improved as well, as I constantly look up how to say things and listen more to Mandarin podcasts.

Even though I miss my son during the weekdays, whom we homeschooled for 18 months during the pandemic, we spend plenty of quality time together after school and during weekends. Instead of playing softball from 10 am – 1:45 pm on the weekends, now I play pickleball from 7 to 9 a.m. to spend more time with family.

We took our children on their first flights to Honolulu, Hawaii in June to see my parents. The trip went well, except for the ER visit after my son cut his head on a pole and needed stitches! This time around, in December, we are more relaxed due to staying in more familiar environments.

Biggest Area In Need Of Improvement

My biggest family miss for 2024 was not being more patient with my wife. We operate at different speeds, which can result in me being more frustrated than I’d like to be. I need to slow down and be more clear and literal when communicating, as she believes she is neurodivergent.

Sometimes, I felt frustrated that no matter how hard I tried to be a good parent, it didn’t feel like enough. The feelings of inadequacy would bubble up when the kids were crying or complaining. In those moments, I had to remind myself that a child’s hardships are opportunities to help them build resilience for the future.

After getting to know more fathers, I also gained more perspective that I was doing OK. One stark contrast is that I never go on business trips, which means I never leave my wife alone to take care of two kids by herself. So when I’m feeling unappreciated or not useful, I remind myself that I’m always there.

2024 Financial Samurai Website And Writing Year In Review: A-

Overall, I wrote over 156 posts (here are the most popular), 52 newsletters (subscribe here), and recorded 30 podcasts (listen on Apple or Spotify). I did not slack off once, even when sick or on vacation. When I total everything up, it sounds like a lot. But it’s about 30% less than what I’m capable of happily doing for an extended period.

I do less because I’m afraid of burnout. It takes a few steps closer every year. Once the burnout virus takes hold, it can engulf the whole body and make you completely sick. I’ve seen many people quit working on their passion projects and never return. I can’t let that happen if my goal is to continue writing until 2037, when my youngest turns 18.

In fact, I was so burned out after 13 years in banking and getting my MBA part-time for three years while working in banking that I permanently quit work altogether at 34 and never returned! In retrospect, it would have been better if I had extended my career for at least five years and relocated to a different office somewhere in the world. That would have been fun.

Writing To Solve Problems And Entertain The Mind

I want to continue writing about real-life dilemmas and solutions. It’s also fun to share new findings and opinions I’ve never considered before. There’s always something new to learn every day. Hearing from readers is also a thrill I look forward to when I wake up. It’s the same feeling as Christmas morning.

Each post provides a sense of accomplishment, which feels rewarding since I don’t have a day job. Once a post has gone from thought to paper, I feel free to do anything I want for the rest of the day guilt-free. It’s the same concept as paying yourself first before spending any money.

Speaking of money, the revenue generated from this site feels like winning the lottery each month because I would do it for free. And because I’d write for free, I’m having much more fun writing about whatever topic comes to mind. To then have no paywall or subscription fee to read my newsletters also feels like I’m making a positive contribution to anybody who wants to improve their finances.

The revenue from this site is enough to cover the $1,600-1,800 per month it costs to run it due to server and maintenance costs, tools I use that have subscription fees, and unexpected technical problems. Whatever is left over mostly gets invested in stocks and real estate.

Finished My Second Book

After more than two years of writing, I’ve finally completed my second personal finance book with Portfolio Penguin! Since July 2024, my wife and I have been diligently editing and refining it. We’re now in the fifth and final major round of revisions after several rounds of reviews and edits by Penguin’s team. The amount of effort that goes into creating a polished final product has given me a newfound appreciation for books.

The next step is to gather supporting blurbs from other authors for the back and inside cover, with a deadline of mid-January 2025. After that, the book should head to the printing presses by March 2025 for a May 6, 2025 target publication.

When Buy This Not That launched in July 2022, one of the most joyful moments was taking my kids to bookstores to search for a copy like a treasure hunt. I can’t wait to experience that again with this new book.

Areas In Need of Improvement

This site faces an existential crisis due to artificial intelligence. As a result, I need to learn how to best leverage AI to increase productivity and expand to other media platforms. But then that starts feeling like work, which reduces the fun of running this site.

I also need to be less reactive to criticism and the occasional hateful comments. It takes up unnecessary energy. My problem is that I enjoy debate.

Overall Grade for 2024: A for Effort, B+ for Results

With a goal of generating an additional $80,000 per year in passive income—or accumulating $2 million more in investable assets—by December 31, 2027, I felt energized throughout the year to earn, save, and invest as aggressively as possible. This ambitious target stemmed from a moment of self-sabotage in 2023 when I purchased my ideal home to raise our kids. Having a purpose to earn feels wonderful!

I’m also thankful that the pandemic is long over. I sometimes remind myself how lucky we are to no longer have restrictions. My wife and I went out to eat more, watched our first musical in 10 years, and went to many events and parties. Experiencing a negative lifestyle from 2020-2021 has helped me better appreciate the freedom we have today.

2024 was truly a lucky year for our finances and I hope for many of yours too. Losing a lot of money in 2022 helps make 2024 feel more special. My plan is to try to keep as much of our financial progress as possible while spending some of our winnings.

Finally, I’m most proud of my kids and their development, as well as continuing to stick to my writing schedule, which I’ve maintained since July 2009. As long as you try your best, you’ll feel good regardless of the outcome.

Thank you 2024! Next up will be my goals for 2025.

Readers, share some of your hits and misses for 2024. What were some things that surprised you on the upside? Where could you have done better?

Subscribe To Financial Samurai

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Your shares, ratings, and reviews are appreciated.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. You can also get my posts e-mailed to you as soon as they are published by subscribing here. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009. Everything is written based on firsthand experience.

Read the full article here